Rise in self-employment eases as construction employment prospects improve

The latest construction-sector labour market data is encouraging, if you are a worker that is.

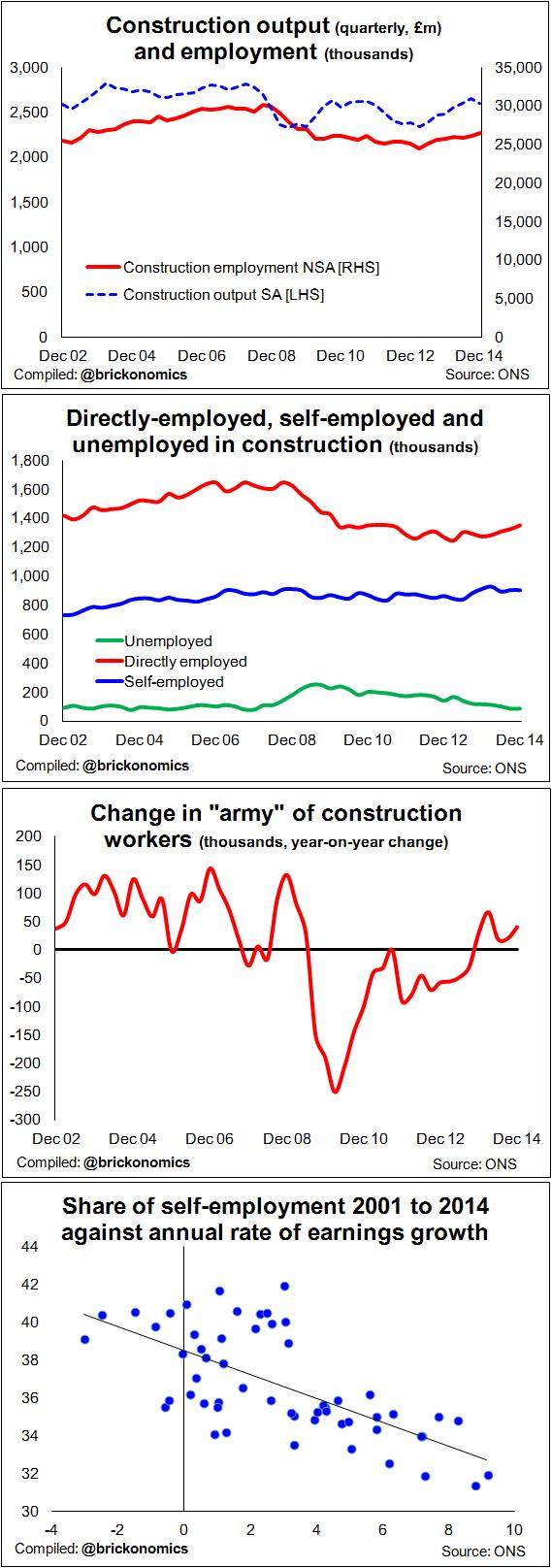

The data show the level of employment at the end of last year was at its highest since 2009. Unemployed former construction workers are now as thin on the ground as they were in the best of times before the recession. And wages appear to be steadily improving. The earnings data suggest total average earnings within construction were up 3.6% on a year ago.

As we see there has been an increase in the “army” of construction workers (those employed and those unemployed, see third graph) over the past year or so. But the progress of rebuilding the construction workforce is slow. The 40,000 increase over 2014 probably owed more to renewing contacts and contracts with labour agents in Eastern Europe.

So with labour in short supply and demand rising. Things look bright for construction workers.

No doubt employers hearing this “good news” may see it rather differently. They will see looming skills shortages and rising labour costs. They will see management headaches with increased uncertainty over both the cost and the availability of labour.

No doubt employers hearing this “good news” may see it rather differently. They will see looming skills shortages and rising labour costs. They will see management headaches with increased uncertainty over both the cost and the availability of labour.

Naturally they’ll do what they can to reduce this, but what?

Well they will look to foreign shores and are already doing so.

But perhaps there’s a hint in the data of another strategy.

One of the more notable details of recent construction labour market data is the pick-up in direct employment and the easing in the growth of self-employment.

Now there are lots of possible explanations for this.

The rate of self-employment is driven by many factors: the desire or need of a firm or a worker for flexibility; redundant workers turning to self-employment while looking for full-time direct employment; uncertainty within firms over the skills needed or the work coming through in the medium term; the level of interest shown by HMRC over clamping down on abuse of the lower tax available through self-employment; and other host of other things.

But here’s a thought. Could the rise in direct employment and a slowdown in the rise in self-employment be a sign that firms are looking to reduce uncertainty? Are firms taking more workers on the books with the aim of controlling risk around labour availability and price shocks?

The data are limited and the time series not that long. But I charted the annual increase in total average earnings against the proportion of self-employed in the construction labour force (see bottom graph).

It’s a simple graph that does not account for other influencing factors. But it seems to suggest that on balance as pay rises increase the level of self-employment in construction eases.

So perhaps we should expect to see the balance between the self-employed and directly employed shift in coming months.