Is the construction industry 13% bigger than we think it is and does it matter?

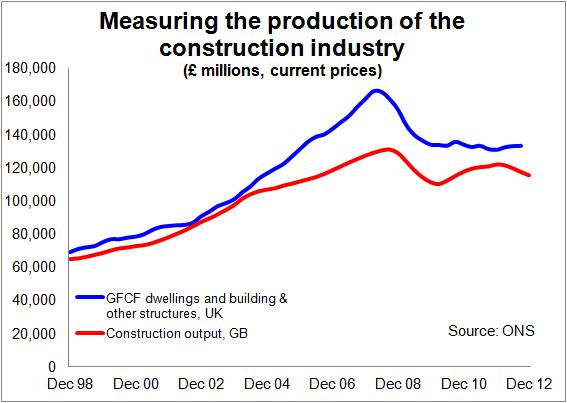

Here’s an intriguing puzzle. Why would an alternative measure of construction activity suggest the industry is about 13% bigger than the official construction output figures show?

Also, why would this measure of the annual increase in capital goods resulting from construction (gross fixed capital formation) suggest the industry has fallen 20% from peak rather than the 10% the construction output figures suggest?

This has been bugging me for some time and some months ago I turned to the Office for National Statistics for advice.

It turns out that this conundrum had been puzzling the Bank of England as well and is being investigated. The investigation, which was due to be completed some while ago, was still ongoing when I last checked.

All this may seem rather esoteric. But in reality policy makers, particularly at the moment, are very concerned with the ups and downs and the size of the construction.

If the figures are saying one thing and the real world is behaving in another then the assumptions driving policy will be suspect. That makes it important.

It’s true the data for UK gross fixed capital formation (GFCF) for dwellings and for buildings and other structures is measured differently from construction output. So there will be different lags in the different data series and other technical differences.

It’s true the data for UK gross fixed capital formation (GFCF) for dwellings and for buildings and other structures is measured differently from construction output. So there will be different lags in the different data series and other technical differences.

Also there will be slight differences in what is covered, plus the regular output series covers just Great Britain not the UK. A total for UK construction output would need to include Northern Ireland’s contribution, which at peak was about £3.4 billion a year and is currently about £2.3 billion.

You wouldn’t expect the GFCF measure and output measure to produce exactly the same figures, even if they covered the same geography and exactly the same components. But in a broad sense they are much the same thing, so you would expect the trends to be fairly similar. Certainly the data series track closely from the late 1990s up to 2004. The gap between annualised GB construction output and UK GFCF was then running well within 10%.

But from being within 4% of each other at the end of 2003 the gap grew to more than 22% by early 2008.

This matters because, if the GFCF figures are actually a better reflection of the real world, it suggests construction was at peak far bigger than we gave it credit for. Discounting for Northern Ireland we’d be looking at GB construction at peak of £160 billion compared with the £130 billion in the official output figures, with the current figures at about £130 billion against £115 billion.

Interestingly the GFCF figures suggest a much harsher recession for the industry than the construction output data suggests.

For me this is fascinating, not least because I have long argued we undercounted the boom (the argument, which you can read here, relates to the measurement of foreign workers and how the construction data was put together before the change in the series when ONS began producing the statistics monthly).

Leaving curiosity over how the numbers are produced to one side, there are serious implications for policy.

That said, given the vagaries of policy making, misinformation may in practice lead to a good or bad result for the construction industry. But for my money when I am making important decisions I prefer to see the world as near as possible as it is rather than how it appears through distorted lenses.