Thank God for the bankers

The latest survey of construction by the surveyors’ body RICS paints a generally brighter picture of the industry’s activity and prospects albeit with some rather dark patches.

A crude summation might be that commercial and housing in London and the South East is doing “good”, while everything else and everywhere else is doing “average” or “bad”.

Or to put it another, perhaps more cynical way, thank God for the bankers.

Because it is in large part down to the resurgence of the banking sector that London is, according to some reports, facing a shortage of offices. This is leading developers, such as Land Securities, to dive back into speculative building

And the spin-off of the creation of highly-paid financial sector jobs is that is buoys demand for housing in a market where only the well off can really compete.

No doubt the irony will not be lost on the folk building the homes and offices that the pay increases among the City folk who are fuelling this upswing in construction work are 10 times greater than those being enjoyed by the people doing the construction work.

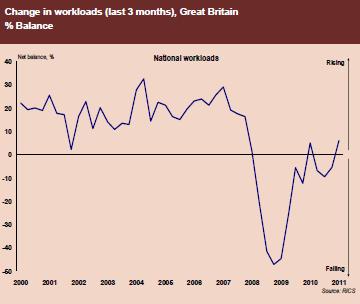

Leaving aside irony, the general picture will provide a little comfort to construction firms and suppliers, as it suggests that there is some buoyancy in the overall market, as the graph taken from the survery (see right) suggests.

Leaving aside irony, the general picture will provide a little comfort to construction firms and suppliers, as it suggests that there is some buoyancy in the overall market, as the graph taken from the survery (see right) suggests.

However, this is not a quatitative survey and it will be some while before we see how much a rising private sector can compensate for the impending falls in public sector work.

Furthermore, the survey needs to be treated with some caution as its respondents are located more heavily in some parts of construction than others. So, for instance, local repair work is unlikely to get much of a showing in the mix, while London offices and housing are probably proportionately over represented.

Also the nature of the work done by the surveyors does tend to make this survey a bit more forward looking in relation to work on the ground. Which is useful.

But while this survey probably exaggerates the trend, it starkly illustrates the broad pattern that we should expect to see within construction over the coming years, as opportunities follow the available money.