Latest jobs figures look pretty upbeat – but…

A first reading of the latest set of jobs figures provides some encouragement both for the nation at large and for those engaged in construction.

Nationally unemployment was down and employment was up, with the rate of those aged 16 or older rising to 70.7% from 70.5% in the three months to March.

Encouragingly the improvement came from more full-time employed jobs, rather than from self-employment or part-time work.

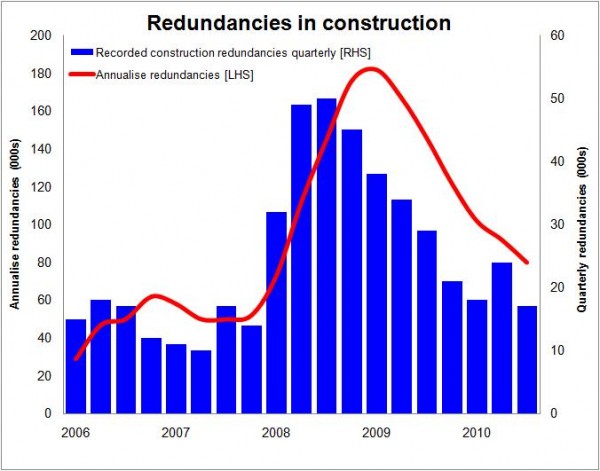

The figures for construction are also encouraging, showing redundancies in the first quarter of this year at the lowest level since 2008 Q2 when the recession began to bite.

The graph above shows how redundancies have fallen close to pre-credit-crunch levels.

And the jolly news for the workforce is that average weekly earnings have risen for the second consecutive month, albeit not at the same rate as consumer price inflation.

The figures show that earnings had fallen in each of the final six months of last year before flattening out in January and showing a gentle rise in February and March.

Compared with other sectors of the economy the rises have been very modest, with construction workers seeing a fraction of the pay rises enjoyed by the overall workforce.

The latest labour market outlook produced by the HR professionals body CIPD suggests that pay pressures are growing, with the workforce expecting higher increases than they were three months ago.

Meanwhile, the Governor of the Bank of England, Mervyn King, alluded in his recent letter to the Chancellor to the potential for wage growth pushing up inflation.

For construction bosses, while it is nice to have a happier workforce, the fear will be that this may be the start of an upswing in wages. This will add to their pressures and uncertainties with costs generally on the up.

It is worth noting however, that the average figures can distort what is really happening on the ground, but the data do suggest pay pressures are currently less in construction than elsewhere.

All that said, the figures do seem to support the view that construction has enjoyed a bit of a reprieve in recent months after the pressures created by the sharp recession.

And when the sums are counted for how many people were employed in construction in the first quarter of this year we might reasonably expect to see a rise.

However, with the economy in an awkward period of transition and with public sector spending cuts yet to impact as they will on construction, the latest figures are probably best seen as a break in the clouds rather than an end to the storm.