A bad time to bank on cutting costs to make up for cut-price bidding

The latest pan-industry construction trade survey put together by the Construction Product Association paints a bleak picture for the months ahead, as falling workload and prices combine with cost inflation to squeeze firms’ already pressured profits.

How ironic that seems after the industry enjoyed one of its best ever years of growth in 2010.

But the trade survey suggests that profit margins have been under significant pressure since the credit crunch in the autumn of 2007. And it would seem that the economic stimulus driven mini boom last year did little to ease the pressure.

From here on most firms expect workload to fall. Meanwhile, work in the bag has been won at cut rates as firms continue to see tender prices fall. And there are clear signs of cost pressures hitting the materials firms and some contracting firms.

Interestingly building contractors are still on balance reporting falling costs. This is on the back of heavy downward pressure on wages.

This fits with all the anecdotal evidence of main contractors being able to cut cost dramatically over recent years. This week the spotlight was on Carillion and a “20% discount rate” expected from its subcontractors.

The market strength of big contractors along with long forward order books packed with large contracts as the recession started to bite, plus the ability to trade down the food chain for smaller works, protected many larger firms from the chill wind of the recession.

The quotes of Rick Willmott, head of Willmott Dixon, in a recent Building article are interesting.

“There is no question that any of the large contractors have actually been in a recession yet. But it’s coming and I see it lasting for as long as five years,” he says.

What is more he adds: “Prices are at rock bottom. There is only one way for them to go next – skywards.”

And quite rightly he highlights the dangerous game being played by contractors who are bidding low to win work.

This concurs with a point I made in an earlier blog last month: “Given this level of suppression in labour costs, it will become increasingly tough for construction firms to push down further on wages. And with global commodity prices now creating an upward pressure on materials costs the room for manoeuvre for contracting firms is narrowing.”

I suggest that any contractor looking at sharpening their pencil on a bid might be well advised to take a thorough look at the latest construction trade survey.

I suggest that any contractor looking at sharpening their pencil on a bid might be well advised to take a thorough look at the latest construction trade survey.

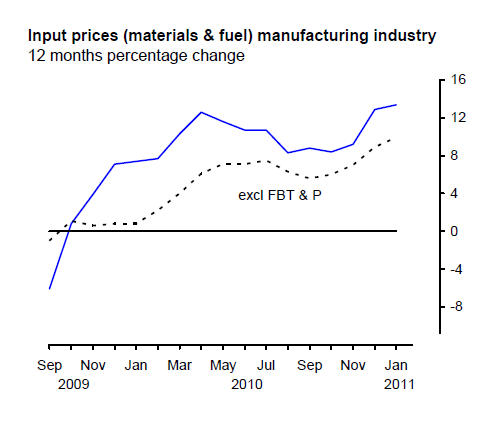

What’s more it would be instructive to have a detailed read of the producer prices index showing the double-digit price hikes hitting manufacturers. Here’s a graph lifted from the latest release that might make you sit up and start asking: “What if that was me at the wrong end of those input prices?”