Some room for optimism to be found in the Experian forecast

The latest Experian forecast on the face of it paints a picture of a rockier road for construction over the coming few years compared with its previous forecast.

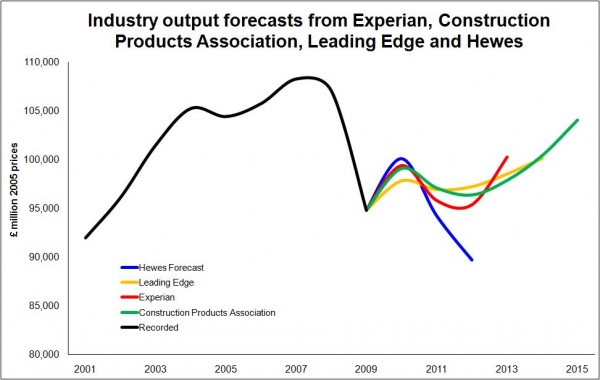

But on balance it is a slightly more optimistic picture of the path ahead for construction than is suggested by other forecast released recently.

The impact of the economic stimulus on construction was perhaps stronger and more immediate than many might have expected and hence the withdrawal of the stimulus and the planned cuts would inevitably lead to a more uneven pattern of workflow than might otherwise have been the case.

Technically this points to a double-dip recession for construction – although pedants might argue it would be a triple dip as the industry already has had two technical recessions since the credit crunch.

But the good news suggested within the Experian forecast is that the private sector is expected to drive strong growth by 2013. And in Experian’s views the risk to its construction forecast are fairly evenly spread.

This suggests a slightlystronger and perhaps earlier recovery than other forecasters were pointing to.

But one important note to make when considering any of the forecasts at the moment is that all of the industry forecasters have been a bit confounded by revisions to the official data.

The problems they face as a result of a shift to a new way of counting construction output are great, particularly as the new data “settles down” as the statisticians are ironing out inevitable wrinkles in their procedures.

And it also presents problems with historic comparisons with and assumptions drawn from the patterns within the old data series.

For instance if we look at the graph we can see the more dramatic curve of the Hewes forecast. This is partly a result of this being based on output figures that have subsequently been heavily revised.

But with huge uncertainties hanging over the forecasts such as the implications of the radical changes to the political landscape in the UK, the continuing global financial worries and inflation, it is in the assessments of the likely impact of these forces on each sector where we find the value in these forecasts, rather than in simply comparing headline figures.

Each forecaster will make different assumptions on the impact of these uncertain forces on each sector. And a slightly different view taken on one particular sector can alter the overall assessment for the industry quite markedly.

For instance Experian is by far the most optimistic on housing output. It suggest that workload in 2013 will be more than £1 billion above that suggested by other forecasters. It is broadly more optimistic too on infrastructure. But on the commercial sector it is perhaps less optimistic.

The position of both Experian and Leading Edge is that the risks lie fairly even balanced between factors that might push output above the forecast and those that might drag it down. Hewes tends to build into its forecast more of the negative risks, on which basis we should assume the risks are probably on the up side. While the view taken by the Construction Products Association appears to suggest the risks lie more on the downside.

So the forecasts should be viewed in this light.

But what is clear from all of the forecasts is that the fate of the industry lies very much in how fast the private sector can fill the gap left by receding public spending.

While the need for a boost to construction is very evident – especially if you are in the business – and there are ambitious plans for improvements to the nation’s built environment, the issue of how construction will be funding in the private sector remains a huge constraint.