Bank figures provide more jitters for the housing market

The latest data on mortage lending from the Bank of England will do little to steady the nerves of those in the house building world.

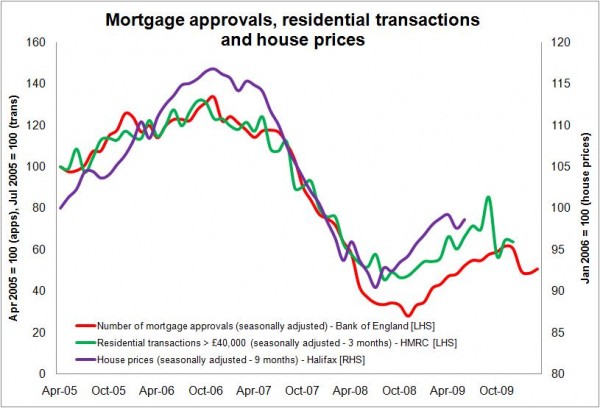

The figures show the number of approvals for house purchases on a seasonally adjusted basis has taken a dip in the first quarter of this year.

The number of mortgages for the first quarter of this year dropped 16% on the final quarter of 2009, although the figure was up 17% on a year ago when the industry was deep in the mire.

But looked at in the longer term the numbers of mortgages being approved is less than half that of the average over the 10 years before the credit crunch.

What makes these mortgage lending figures particularly unsettling for house builders and other home sellers is the possible link between falling numbers of mortgages and falling house prices a few months later.

What makes these mortgage lending figures particularly unsettling for house builders and other home sellers is the possible link between falling numbers of mortgages and falling house prices a few months later.

The graph shows the recent relationship between mortgage approvals, with property transactions lagged by three months and house prices lagged by nine months.

What is not clear is whether the dip in mortgage lending is connected either with the stamp duty holiday ending or the run up to the General Election.

But looking further afield for runes to read, if I were a house builder the most worrying omen for me would be this headline in the Daily Express yesterday.

One thought on “Bank figures provide more jitters for the housing market”

Absolutely. Could agree more. Once again, brickonomics goes right to the core of the problem. Rising house prices in the last few years made homeowners feel rich, they spent and borrowed on the back of that….. you know the rest. Soaring house prices = bad thing, Gradual , sustainable increases in property investment = good thing.

Comments are closed.