We’re back to double-digit growth in house prices, oh dear

House prices are booming again, crack open the champagne!

Well maybe not.

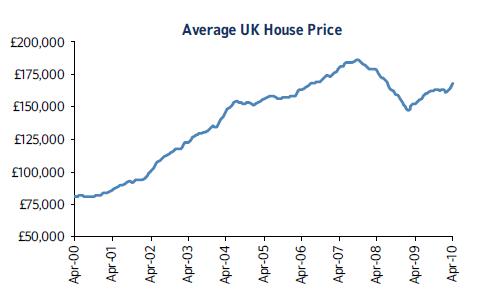

If I was a house builder reading the latest survey from the Nationwide building society showing a double-digit rise in prices over the past year (see graph) I would be worried.

Looking at my short-term prospects, naturally I would be chirpy about the larger profit margin I could reasonably expect on my future sales.

Looking at my short-term prospects, naturally I would be chirpy about the larger profit margin I could reasonably expect on my future sales.

Naturally I would be upbeat about how price competitive I can now be against the second-hand market.

And naturally I would be relieved that some of my weaker sites that were financially “under water” may now be floating in the region of profitable enough to build out.

But I would still be worried about the implications for my business in the long run.

I’d certainly be miffed if the buoyancy in house prices prompted land sellers to look for more inflated prices.

And reading the excellent commentary that accompanies the Nationwide survey results by the society’s chief economist Martin Gahbauer seeds of doubt would creep in.

Gahbauer doesn’t suggest a crash, he doesn’t mention double dip, but then again I’d be surprised if he did. What he does look at are the players in the market, the context and the likely mechanisms driving the market.

Here basically is the story as he tells it, at least as I read it.

House prices started to plunge in November 2007 with accelerating pace.

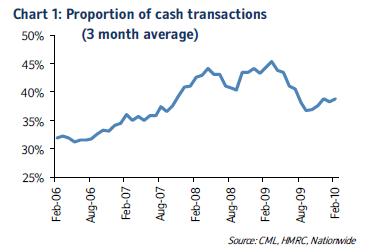

From the spring of 2008 for about a year or so cash buyers became much more dominant among buyers and will have helped to put a floor under the falling market (see graph).

From the spring of 2008 for about a year or so cash buyers became much more dominant among buyers and will have helped to put a floor under the falling market (see graph).

The market’s mood shifted in the early last summer, prices began to rise and the cash buyers began stepping out of the market, with mortgage backed purchases taking up the reins as confidence returned.

However, with relatively few distressed or forced sales (partly as a result of exceptionally low interest rates) there was a shortage of homes on the market even given the historically fairly constrained level of demand. This helped to support rising prices, which were quite rapid last summer. This was, he suggests, down to homeowners and buy-to-let owners being able to sit it out and wait for house prices to bounce back closer to 2007 levels. This they could do because interest charges were low.

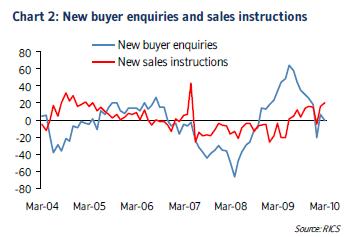

But he says there is now evidence of a shift in the supply-demand balance, certainly this is the impression from recent RICS surveys (see graph) and indeed others.

But he says there is now evidence of a shift in the supply-demand balance, certainly this is the impression from recent RICS surveys (see graph) and indeed others.

However, implicit in this analysis is the haunting prospect that there may be, particularly if prices start to flatten, a surge of properties coming on the market from would be sellers, either buy-to-letters or homeowners looking to cash in at higher prices.

Meanwhile, not meantioned in Gahbauer’s commentary, is the possibility that with the economic backdrop pretty bleak given the public finances and with a slew of job losses likely in the public sector, the chances of buyers going back into their shells is much increased. The economic consultants at Capital Economics expect cuts of 750,000 over the next Parliament, taking unemployment well above 3 million.

If there is a surge in homes coming onto the market and demand fades away this will damage the fragile recovey in the housing market.

So there is an irony here for house builders, rapidly rising prices will mean better short term profitability, but it might also help to swell the supply of second hand homes and in the process lead to a double dip in prices.

Meanwhile, long term it is hard to escape the obvious fact that rising house prices excludes increasing numbers of potential buyers.

Meanwhile, long term it is hard to escape the obvious fact that rising house prices excludes increasing numbers of potential buyers.

If you accept the notion that earnings and house prices are broadly related in the long run, as they were in the last 70 years of the 20th Century, then it is clear that prices were very toppy even a year ago, before the 10% rise (see graph).

Better, perhaps, for less excitement and a little less uncertainty, less risk and more sustainable rates of growth.

All the graphs are taken from the Nationwide press release.