Punch drunk construction finds a prop in rich investors in London housing

Yes folks the construction industry is partying like it was 1999. Sounds like fun, but sadly it means that all the growth achieved this century has been wiped out.

And while we metaphorically vomit into the punch bowl, here’s a thought to sober us up.

If it wasn’t for rich foreign and indeed rich British investors pumping cash into London residential property the construction industry would probably be closing in on a drop of nearer to a quarter from peak instead of the 19% drop it has taken to date.

That extra drop would have had us partying like it was 1996, which doesn’t sound anywhere near as attractive.

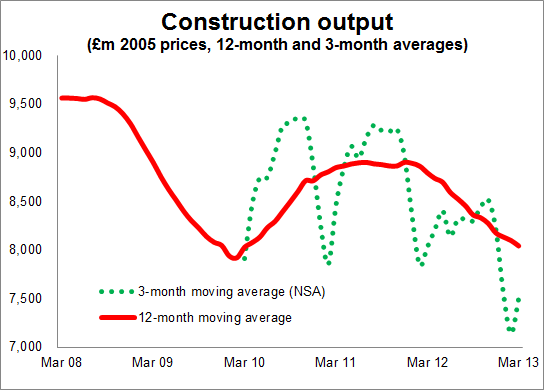

Looking at the picture in wide angle the latest data out today shows construction continues on a downward path. And indeed on a quarterly measure the industry is doing about the same amount of work as it was in the first quarter of 1999. The peg for that awful pun earlier (sorry).

This we more or less knew from the GDP first estimate figures. The fall shown in the latest output figures of 2.4% in the first quarter was more or less in line with the -2.5% figure posted within the GDP data. But because of revisions to earlier figures the industry probably saw about £100 million or so less work in the first three months than the Office for National Statistics estimated earlier.

This we more or less knew from the GDP first estimate figures. The fall shown in the latest output figures of 2.4% in the first quarter was more or less in line with the -2.5% figure posted within the GDP data. But because of revisions to earlier figures the industry probably saw about £100 million or so less work in the first three months than the Office for National Statistics estimated earlier.

Overall there was little in the latest set of data to surprise. Rather it reinforces yet again the dismal demand for the industry’s wares. Well not all of them, as we shall see.

The graph which plots 12-monthly and 3-monthly average volumes of work pretty much tells the story are regards the overall pattern of business in construction. Downward.

Anyway, delve a little deeper into the data and you find some intriguing if not disturbing patterns.

Here’s one. What the aggregate figures don’t show is the impact of the boom in housing in London. The flood of foreign money and indeed investment by rich Brits is driving not just the London construction economy but has provided a major prop to the industry at a national level.

If you take out housing and infrastructure (which is distorted as it is receiving a one-off boost from CrossRail) from the capital’s construction output we see a fall in cash terms of about 5%. Adjust this for inflation and we are looking at a drop probably of about 10% or more in volumes.

Here’s a stat. From 25% of total London construction in 2007, housing new and refurbishment now accounts for 31%.

The ONS figures suggest that work on building new homes and improving and repairing existing homes in London represented about 4% of total British construction output in 2007. That proportion jumped to 6.6% in 2012.

We could take a stab and interpret this as investment by rich foreign and I suspect rich British investors in luxury London residential property is probably providing about 3% or more of GB construction.

Yes the data are estimates and should be treated with caution, but the broad picture they paint is very unsettling given the emphasis place by politicians on rebalancing the economy.