Some lessons to learn from the constant downward revisions to construction forecasts

The recession in construction will be longer and deeper than we thought three months ago. That is the message in the latest set of industry forecasts emerging this month.

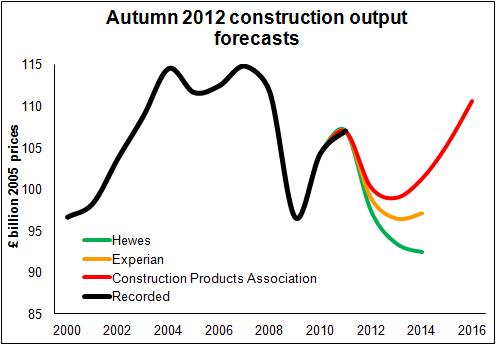

This may evoke a sense of déjà vu. Each quarter of late the forecasts have darkened. The latest set look pretty bleak as we can see from the graph.

But what is this telling us about the state of construction and what we should expect?

But what is this telling us about the state of construction and what we should expect?

The first thing to note is that the downward revisions seem to be increasingly focused on the private sectors, notably housing and commercial new work.

You could blame the forecasters for getting things wrong. That would be silly. Firstly the back data changes which forces revisions. Secondly the chances of forecasters being bang on are very slim when trying to predict complex things such as the direction and speed of change in the construction industry.

If they were bang on every time, even I’d be considering whether or not they were dabbling in witchcraft.

In turbulent times the text of forecasts is very important. And the reality is that the uncertainties (upside and downside risks) mentioned in each forecast have been weighted heavily to the downside. As we have seen with global economic forecasts these downside risks have increasingly crystallised into hard reality. So downward revisions should be expected.

From where I sit, it is more instructive to examine what has changed in the view of the forecasters and what are the implications.

Looking back to how we got here might help. So I revisited a blog from about two years ago when I reviewed the first set of forecasts after the new Government had settled in.

The first point to note is that the forecasts for where we are today look pretty reasonable in terms of the level of work expected.

Oddly, if anything the forecasts from two years ago come out lower in volume terms than where we actually are now. But if we look at growth rates the forecasts then for the year we now face were much more positive.

The forecasters appear to have understated the surge caused by the stimulus set in place by the previous Labour administration, so the worrying drop we see now is partly as a result of coming from a higher level than was expected back in late 2010.

The view then was clearly that construction was set for a double dip into recession. But the consensus pointed towards a fairly shallow dip followed by recovery towards the end of 2012 or early in 2013. What we see in today’s forecasts is a deep and fairly protracted double dip.

That said the Hewes forecast then and now was far bleaker than the consensus. But Hewes does tend to factor in more of the downside risks than others.

Anyway, looking to that December 6th blog, the final four paragraphs read:

“What we know is that public sector spending on construction will shrink, although whether the planned cuts will in the end be achieved as quickly as the Government hopes is up for question.

What we hope is that the bounce back in the private sector that we have seen in recent quarters will be sustained and of sufficient strength to foster growth overall.

What we don’t know is how exactly such huge cuts in public sector spending will feed through to the private sector and how this might impact on construction.

On balance though it seems fair to assume that the risks, particularly the big risks, are on the downside.”

So there were big downside risks that on average might swing the construction sector lower than the forecasts central position. The forecasters knew this and recognised it in their commentaries. We should then not be surprised by the current downward revisions in the forecasts.

For me of more interest is the point regarding lack of certainty surrounding the impact of the public sector cuts on private sector activity.

There are two elements to consider here. Firstly there is the impact on aggregate demand and GDP of cuts to public sector spending, which in turn feed through to private sector demand for construction. Secondly there is the more direct impact of public sector cuts to construction spending impacting on related private sector construction.

The first of those is very interesting to consider in light of the latest forecast by the IMF and its commentary on fiscal multipliers. There seems to have been a change of heart. It seems that the IMF now thinks that cuts in public expenditure create rather more of a dent in the gross domestic product than it used to think.

Given that construction output is highly sensitive to changes in GDP we might expect that the drop in public sector spending has a disproportionate impact through this effect on construction than on the economy as a whole.

But without delving into the detail and theory of fiscal multipliers it may be more helpful to consider the second point and the more immediate impact of public sector investment on private sector construction. For instance it is clear that, as often as not, the construction of a new public road will directly prompt construction of new shops or offices as new locations and opportunities are opened up. And there are many other examples of similar direct impacts from public investment that we could choose.

What is unclear is the exact leverage effect of public sector spending on construction on private sector spending on construction and consequently the impact of cuts. It will vary case to case, location to location and over time.

However, it is very evident to those who have been in the industry for a long while just how integrated public and private sector spending on construction has become.

The London Docklands development in the 1980s is a prime example of how integrated the sectors became. Here the measure of success became explicitly the leverage effect of public sector funding – how much each pound of public money generated in private sector investment.

More recently the work of the Homes & Communities Agency also focuses very much on using public sector funding as catalyst and supporter for private sector investment.

If we examine the recent revisions to the forecasts we see that they are more heavily focused on the private sector, housing and commercial in particular. Optimism over these sectors is waning disturbingly.

If I wanted to draw an interesting observation from the shape of construction activity and the changing forecasts as they have been presented over time it would be this.

When the Labour administration boosted public sector spending on construction, by pulling forward earmarked funding, the private sector fared better than was expected by the forecasters.

With deep cuts in public sector investment the private sector is performing worse than the forecasters expected.

This may be coincidence, but if the impact of public sector cuts is far greater than many might have expected and the reverse is also true, with the stimulus impact being far greater, then the case for the Government to invest more freely in construction seems to be far stronger.

Furthermore, we see regularly quoted the industry-sponsored work on the multiplier effect of construction, which does seem to support the case for construction investment by the Government to boost the overall economy. And we know that a streamline infrastructure should help to improve the nation’s economic efficiency and future growth prospects.

Encouragingly these arguments appear to carry increasing weight among politicians. Sadly, while their words flow freely, hard cash for construction remains very constrained.

One thought on “Some lessons to learn from the constant downward revisions to construction forecasts”

Mr. Green offers a lot of verbiage but misses the point entirely. Construction as we know it is over. The planet can’t support the type of construction we’ve done for the past 60 years. There is no future for traditional construction. It’s time the economists gave up on that moment of glory and moved on to better ways to focus our resources.

Comments are closed.