Output data suggest it’s past time for the Government to act decisively to boost construction

There will be some people expelling phews of relief at seeing construction output for the second quarter revised up by the Office for National Statistics from a dramatic drop of 5.2% to a less frightful fall of 3.9%.

Certainly this will have the effect, all other things being equal, of lifting the rather shocking GDP drop of 0.7% by 0.1% or so. Not much, but a little.

However, the revisions change the narrative very little.

Following the release of the shocking GDP figures last month there was some comfort drawn from assuming that bad weather was a big factor in the implied deep plunge in construction output in June. If that were true we should then expect a bit of an upward bounce in work in July.

However, if the fall was smaller than first thought, it kind of suggests that the emphasis put of the weather effect was overcooked and the impact should be less. So we should reasonably expect less of a bounce back in work in July.

On balance things are probably not that different from what we thought when the GDP preliminary estimates were released.

On balance things are probably not that different from what we thought when the GDP preliminary estimates were released.

That is, they are ugly for construction.

The issue is not whether the industry contracted 3.9% or 5.2% in the second quarter of this year. It is not about whether the ONS data are pinpoint accurate or not.

The problem is not so much what lies behind construction as what lies ahead.

If anything seeing the full spreadsheet of ONS construction output data brings home the very nasty state of affairs.

The only sector to show growth quarter on quarter was non-housing repair and maintenance and that was pretty much flat when you consider how accurately you can measure these things.

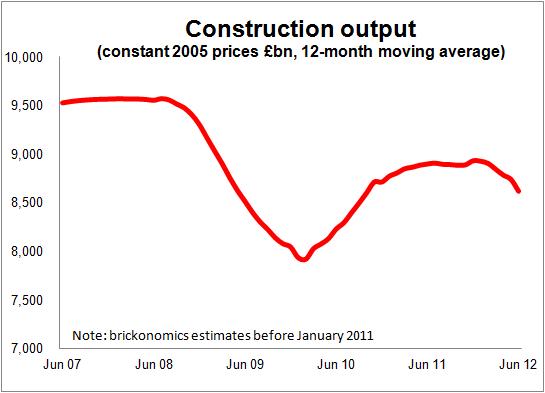

Despite only telling part of the story the graph above shows how rapidly construction output is falling.

But the pattern is clear.

Public sector construction is in sharp decline. Construction work associated with new public housing is less than half what it was two years ago and public non-housing is about 45% down.

But instead of picking up the slack left by this rapid retreat of the public sector, the private sector is now also in decline after having shown some signs of recovery in 2010 and 2011.

Construction work in private housing is almost 40% below its peak and after its recovery from the hell of mid 2009 it fell back sharply again in the second quarter. Private commercial building work is more than 30% below its peak and it too is declining again after its hint at recovery.

These two sectors were both earmarked to drive construction from recession as public sector spending fell sharply. That they clearly are not doing.

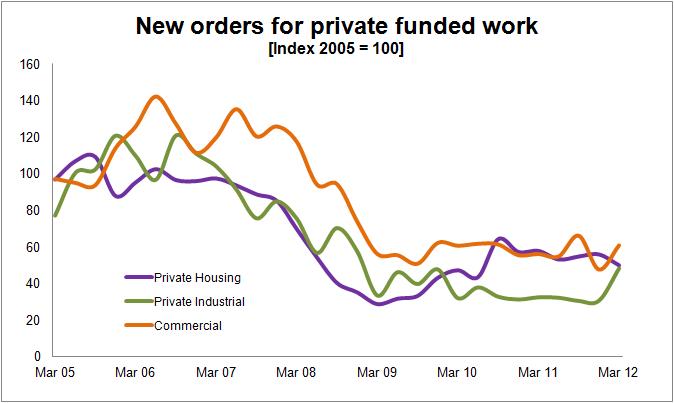

What is more distressing is that there is no clear sign as we look up the pipeline of where the boost in private work will come from.

What is more distressing is that there is no clear sign as we look up the pipeline of where the boost in private work will come from.

The official construction new orders figures are the last place an optimist should look for comfort as the graph (right) suggests. Meanwhile the latest pan-industry trade survey compiled by the Construction Products Association points to expectations drifting south at a worrying rate.

The Government has made much of the impact construction could have on improving the overall economy.

It’s already too late for it to have an immediate impact and to slow the current sharp slide into recession.

But it is never too late for it to do something that will have an impact down the line. And decisive action now could have a short-term very positive impact on confidence.

I suspect there are ministers already fretful and embarrassed about their piss-poor efforts to spark into life a genuine recovery in construction given the continual rhetoric from Cameron and Clegg. Particularly after the big negative impact plunging construction had on the GDP numbers.

We have been promised on many occasions a revolution in both infrastructure investment and in house building. The Victorians have been dragged into the debate to suggest we are on the cusp of something really big.

Perhaps the more thoughtful and grounded ministers within Government should take a long hard look at the latest data and marshal their arguments to convince their colleagues of the case for construction. Perhaps they should come up with initiatives that work well rather than sound good.

One small point if any policy makers are reading. Building useful assets may add to debt (not necessarily Government debt). But such investment is not squandered on indulgent consumption. The assets remain on the balance sheet for a very long time – some (e.g. housing) can even increase handsomely in value over time.

In the meantime construction generates jobs, taking people from the dole (sparing the Treasury budget). It also generates much-needed activity elsewhere in the economy (boosting the Treasury coffers).

If I may make one small and gentle request, that I suspect is being mouthed by many a construction executive: “Get your bloody act together and do something useful for construction instead of talking about it.”