Housing market hits a boggy patch

Most of the recently released housing indicators suggest the market is going through a boggy patch and today’s survey from the surveyors’ body RICS seems to add support to that view.

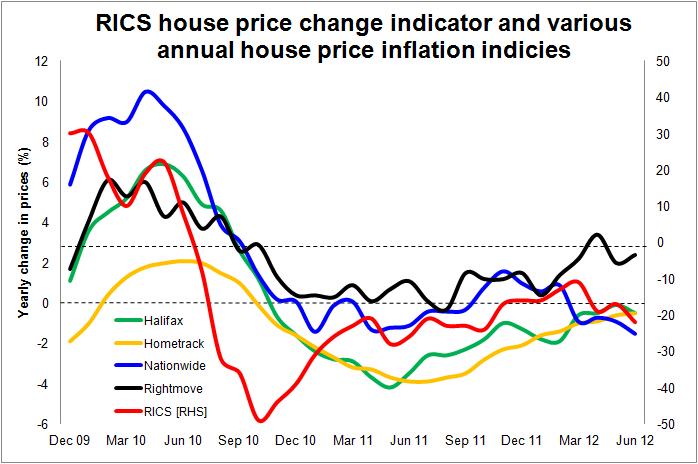

The price indicators are mostly slightly negative on the annual change measure (see graph). This is a path they have followed for a while, so not too much should be read into any slight changes either way.

But the wider measures recorded by the RICS and Hometrack surveys, among others, point to tougher conditions for those looking to sell homes.

Unpicking the data to find the causes is not easy. The end of the Stamp Duty holiday in late March will have caused a ripple in the market with buyers looking to get in under the wire which would tend to concentrate sales ahead of the cut-off date. This naturally would lead to a slump afterwards.

Certainly the housing transactions figures appear to be less impressive so far in the second quarter of this year than in the first. That said the very gentle rise in mortgage approvals continued through to May according to Bank of England data.

But in recent months we have seen tax and benefit changes biting harder into family incomes, increasing uncertainty over the fate of the Euro and the UK economy re-enter recession. So there are plenty of other factors weighing on the minds of prospective buyers.

What however is noteworthy is the Rightmove survey shows that asking prices are still strong, suggesting that sellers are not lowering their aspirations.

Both the RICS survey and Hometrack data show that the numbers of people looking to buy fell back in June. But while Hometrack data points to a small increase in property listings (although smaller than in the previous month) RICS figures suggest fewer people put their homes up for sale. Either way both sets of data point to a quieter June.

Looking at the available data for sales by house builders also points to a tougher market.

The latest Housing Market Report from the HBF and NHBC shows weakening prices and increases in incentives being used in the period to May. But more positively site visits and net reservations are up.

And while the market is seen as fragile, the consensus for house price changes points to a similar pattern over the coming year as over the past year, broadly flat, perhaps slightly down, but definitely falling in real terms.

That will, I suspect, please Grant Shapps the Housing Minister who is keen to see house prices fall in relation to earnings.

One thought on “Housing market hits a boggy patch”

Lesson in economics No 1 : The BoE prints billions every day. Your house is not what it seems.Your pension is pointless. Your savings are wasted.

Lesson in economics No 2 : If you want to be rich own a bank not a house.

Comments are closed.