How the official statistics for construction output compare with the trade surveys

Today’s Office for National Statistics construction output figures seem to correspond broadly with the picture emerging from recent trade surveys.

The output data point to a sharp fall in construction in the first quarter, with public sector work taking a hammering.

The drop may be more severe than one might have expected looking at the balance of data from the trade surveys, but across the piece with the odd exception the trade surveys do suggest a poor start to the year.

Encouraging, they also pick up some positive signs for the future, although in the context of a very weak economy these should be treated with some caution.

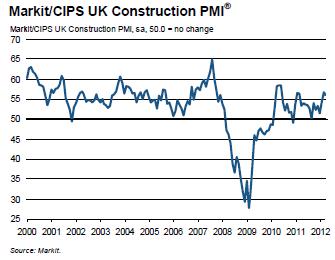

The Markit/CIPS survey (see left), much favoured by City economist, as usual provided the jolliest findings. This may be why City economists were so surprised at the preliminary estimate of construction output showing a fall in the recent GDP figures.

The Markit/CIPS survey (see left), much favoured by City economist, as usual provided the jolliest findings. This may be why City economists were so surprised at the preliminary estimate of construction output showing a fall in the recent GDP figures.

For many years I and others have commented that it has a tendency towards an optimistic view of construction. To accept this survey at face value is to accept that the industry has experienced growth in every month bar one for the past two years. This seems to conflict with much other evidence.

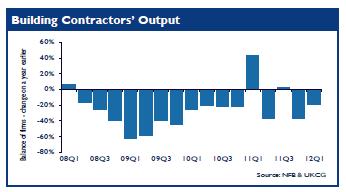

The construction trade survey compiled by the Construction Products Association from surveys of various trade bodies suggests that work on the ground was rather slower in the first quarter than a year ago (see below the contractors graph).

In did note that this year’s first quarter performance was likely to compare less favourably with last year because workload in early 2011 was buoyed as firms played catch-up after a bout of very poor weather in late 2010.

In did note that this year’s first quarter performance was likely to compare less favourably with last year because workload in early 2011 was buoyed as firms played catch-up after a bout of very poor weather in late 2010.

Despite that, the sounding from the medium and large building contractors suggest the main building sectors were in decline, with the exception of private housing and commercial. This was echoed in the findings from smaller firms.

The one bright spot appears to have been civil engineering where contractors reported growth in the first quarter.

The real winners in the first quarter were the materials firms who saw sales rise, but this was put down to growing sales overseas.

But looking across the piece the picture remains pretty weak, with large and small contractors reporting falling orders and inquiries.

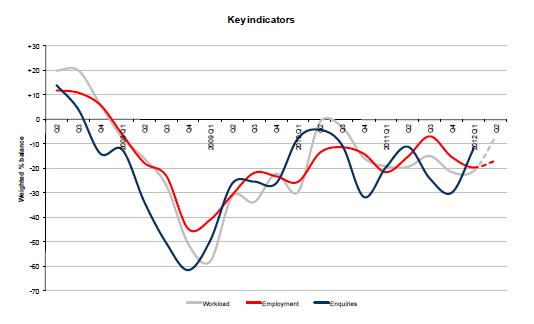

The survey from the Federation of Master Builders (see left) suggests things have been far worse for small local builders. Its survey has remained negative since 2008 with a brief exception in mid 2010.

The survey from the Federation of Master Builders (see left) suggests things have been far worse for small local builders. Its survey has remained negative since 2008 with a brief exception in mid 2010.

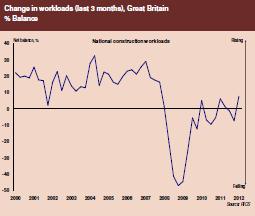

A more positive view of the industry and its prospects comes from the latest construction market survey from the surveyors’ body RICS. This showed more firms reporting work rising than falling in the first quarter of this year. This follows two quarters when the finding suggested workloads were in decline.

It’s worth noting that this survey tends to run ahead of the data recording construction work on the ground, as many of the respondents work is in the early stages of the construction process.

It’s worth noting that this survey tends to run ahead of the data recording construction work on the ground, as many of the respondents work is in the early stages of the construction process.

For all the signs of optimism in this survey it should be treated with some caution. The significant change in the mix and location of work coming through the system may well be distorting the survey results. So, for instance, given the nature of the respondents the survey might give more weight than is due to those sectors that are doing better – private housing and commercial.

One thing the survey certainly underlines is the big shift going on in the source of growth in construction work – higher in the south, lower in the north and up in the private sector and down in the public sector.

One thought on “How the official statistics for construction output compare with the trade surveys”

Good comments on the Markit survey – am particularly concerned about the housing component of it. You used to be able to draw a pretty tight correlation between it and NHBC starts, but the two have diverged since the middle of last year and Markit really failed to capture the slowdown in Q4. Given that the majors now seem to be doing fairly nicely even while the industry as a whole is struggling, it’s tempting to think that Markit are weighting the larger end of the market too heavily.

Comments are closed.