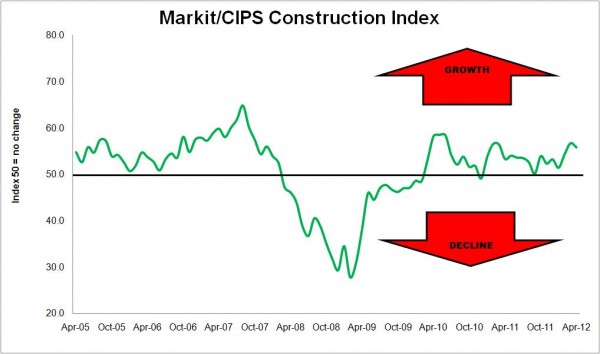

As official figures point to decline, Markit/CIPS survey suggests the good times are back

The latest construction survey from Markit/CIPS points once again to an industry firmly in growth. Its main PMI indicator for April reads 55.8, with 50 being no growth.

This reading will put more heat into the row over whether the official statistics that show construction in recession provide a fair reading.

Although the Markit/CIPS survey shows suggests a slight relaxation in growth when compared with last month’s reading, it continues a trend that points to pretty respectable growth.

The recent readings were 51.4 in January, 54.3 in February and 56.7 in March.

The survey suggested each of its three main sectors – housing, commercial and civils – had seen activity increase in April, when seasonally adjusted.

The index for employment was also positive. This will puzzle many given the number of announcements from contractors about restructuring and job cuts in the media of late.

And the view that there is “resilient confidence in the outlook for business activity over the next 12 months” will further puzzle those in regular conversations with contractors.

Last week the survey was very much at the centre of a difference of opinion over how well the construction industry is performing.

The official preliminary estimate of construction output within the GDP figures suggested the industry collapsed by 3% in the first quarter. This, according to the Office of National Statistics helped throw the nation into a technical recession.

Many City economists argued that the ONS data must be faulty and plenty pointed to the buoyancy of the Markit/CIPS snapshot indicator for construction as evidence.

The survey has been positive in every month since March 2010 with the exception of December 2010 when the industry was hit hard by bad weather.

This suggests a pretty buoyant industry as the graph above shows.

However this particular index has a history of being very positive in comparison with other indicators and many if not most specialist construction economists and industry commentators are wary of the level of its monthly findings.

For instance there have been just two months (October and December 2008) since it started in April 1997 when its business expectations measure has pointed to decline. That certainly suggests, in this reading at least, there is significant optimism bias.

For my part the many conversations I have had suggest that much of the industry is resigned to a tough time.

This does not really fit with an indicator that suggests growth is pretty much back to how it was in the good old days before the global financial crisis.