Architects, engineers and consultants are boosting turnover as they focus on overseas markets

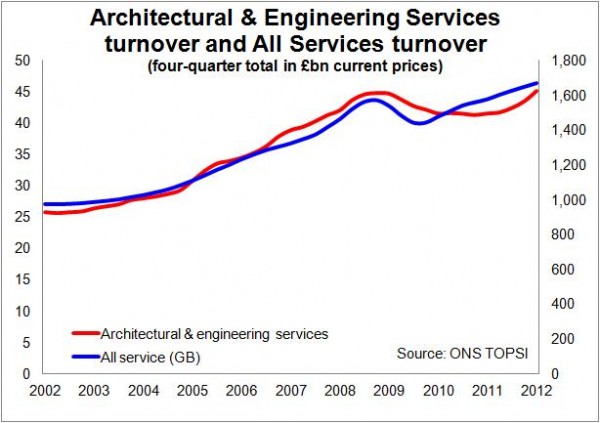

UK architectural and engineering services businesses are now turning over more in cash terms than they were at the peak of late 2008.

That at least is what the latest Turnover and Orders in Production and Services Industries data from the Office for National Statistics suggests.

Naturally in real terms firms have taken a hit through a spell of relatively high inflation over the period. But adjusting for CPI inflation turnover in the first quarter of this year was about equal to the first quarter figure of 2008.

Naturally in real terms firms have taken a hit through a spell of relatively high inflation over the period. But adjusting for CPI inflation turnover in the first quarter of this year was about equal to the first quarter figure of 2008.

And the signs over the past few months have been positive with a strong surge in turnover in the past two quarters.

While this is good news for UK firms it does not mean that UK construction is doing well. The likely driver behind these data is most probably the efforts being made to secure work from abroad.

This view certainly fits with both anecdotal and survey evidence from the consultant’s trade body ACE that overseas markets are becoming an increasingly large slice of its members’ turnover.

Meanwhile in the UK architects’ workloads, at least, do seem to be suppressed, according to data from the consultants at Mirza & Nacey Research. Its Construction Futures data provide a measure of the value of construction work in architects’ commissions. This shows that levels of UK work remain well below the peak, as the graph shows.

Meanwhile in the UK architects’ workloads, at least, do seem to be suppressed, according to data from the consultants at Mirza & Nacey Research. Its Construction Futures data provide a measure of the value of construction work in architects’ commissions. This shows that levels of UK work remain well below the peak, as the graph shows.

Indeed this data does present a similar picture to the official new orders data, which suggest that we may see construction work falling further for many months hence.

Addendum (21 May 2012): I should have added to this the latest findings from the Future Trends Survey released late last week by the architects’ body RIBA .

It paints a reasonably uplifting picture of the future, with architects on balance positive about future workload in the three months to April, although they were a shade less positive in April than in March.

This positive mood has been driven mainly by optimism over private housing work and to a lesser extent commercial work.

Encouragingly April was the first month since the survey was started in January 2009 the respondents expecting permanent staff to expand matched those who said they expected staff to be cut.