So what should we expect the housing market to do in 2012?

The various data suggesting how house prices shifted over 2011 are mostly in and the vast array of pundits have made their predictions for the market in 2012.

So here’s a round up of the prospects for the housing market in the year ahead and a suggestion of what it might all mean for house building.

If we look at all the indicators, the picture painted for 2011 was of house prices flatlining. Some indicators were up a little, some down a little. That fits pretty well with the consensus drawn from the pundits a year ago.

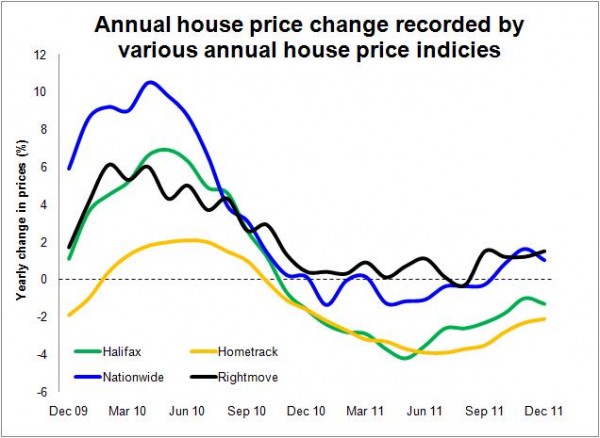

The graph shows how the various indicies suggests that the annual price rise has eased and is now flat or possibly on a path of gentle decline. Taking inflation into account what we saw in 2011 was a real-terms fall in prices.

The graph shows how the various indicies suggests that the annual price rise has eased and is now flat or possibly on a path of gentle decline. Taking inflation into account what we saw in 2011 was a real-terms fall in prices.

The best bet for this year, looking at the array of forecasts, seems to be to expect much the same again – some forecasters expect a slight rise, some a flat market and others a fall.

The big difference this year is that any qualifying notes associated with forecasts are much more likely to carry hefty warnings of a big downside risk if the eurozone collapses.

One factor we have to take into account in these figures is that they are so heavily influenced by the London market and in many ways that operates almost as if it were a separate country. The capital’s housing market has been strongly supported in recent years by an influx of international investment.

The general view is that the disparity between London and the rest of the UK may not be as stark this year as last, but prices in the capital and the south are expected to be far more resiliant than elsewhere.

Here is a selected list of recent forecasts listed from the more bullish to more bearish, with their last year punts for 2011 in brackets. These just give a flavour and I have not put down the index against which each is measured.

Below that I have summarised the key factors that the forecasters have tended to point to. The judgement on where prices will end up roughly rests on how strong they feel each of these factors is in relation to the others.

- Cluttons: 3% rise (Broadly flat)

- CEBR: 1.6% rise (1% rise)

- OBR 0.2% rise (3% fall)

- Jones Lang LaSalle: Flat (1% fall)

- PS&A Future HPI: Flat (8% fall)

- Median of independent forecasters 1.7% fall (2% fall)

- Savills: 2% fall (3% fall)

- Rightmove: 2% rise (5% fall)

- RICS: 3% fall (2% fall)

- Hometrack: 3% fall (2% fall)

- Oxford Economics: 3% fall (3% fall)

- Capital Economics: 5% fall (10% fall)

The main factors put forward for holding up prices appear to be:

- Ultra-low interest rates

- Rising rents

- Shortage of housing supply in the market caused by:

- Bank forbearance restricting distressed sales

- Low new-build rates

- Sellers able to rent out and hold onto housing rather than sell below aspiration

The main factors expected to press down on prices appear to be:

- Economic uncertainty

- Tightening lending criteria

- Unemployment

- Squeezed household finances

But for house building price is just one factor that influences the market and whether homes are built or not built.

Probably of more interest are expectations for the number of housing transactions. Here looking at forecasts from the Office for Budget Responsibility, the Council of Mortgage Lenders, Savills and Jones Lang LaSalle, the suggestion on balance is that we should expect a slight drop in house sales this year compared with 2011.

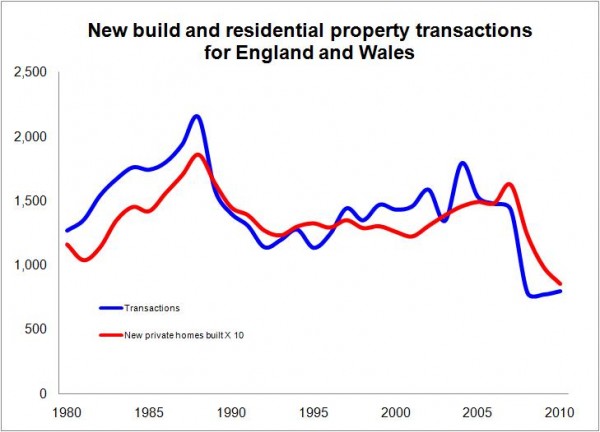

The worry for the industry here is that the number of new private homes built has for many years (since the late 1970s at least) tracked very closely with the total number of housing transactions. The graph (using DCLG house building figures and HMRC transactions data put together by the Council of Mortgage Lenders) illustrates just how closely new private house completions track the total sales in the market in England and Wales.

The worry for the industry here is that the number of new private homes built has for many years (since the late 1970s at least) tracked very closely with the total number of housing transactions. The graph (using DCLG house building figures and HMRC transactions data put together by the Council of Mortgage Lenders) illustrates just how closely new private house completions track the total sales in the market in England and Wales.

So, while the Government has introduced a number of schemes to boost house building, the wider market conditions seem to be telling us that the growth in private house sales will be constrained.

Add into the mix downward pressure on the social sector and the picture for house completions looks pretty weak this year. Indeed, the Construction Products Association reckons that house completions this year will be about 5% down on 2011.

So for those looking for where the action is in the UK house building sector, it will probably be in much the same places as last year. The emphasis will remain on southern England and the more affluent areas, where folk with existing housing equity are keen to live.

One thought on “So what should we expect the housing market to do in 2012?”

BMV Properties, what is the real deal?

There are ways to save money and one of them is “not to lose due to greed”.

Now a days there are various companies offering you to take advantage of recession and provide you with “below market value / BMV properties”, some of the names are Choices Acquisitions part of bigger group and also operate as choices co uk estate agents, fasttrackproperty, Axis etc (google bmv properties).

Most companies have free or reasonable membership fee (below £100) should you decide to become their member but some are over the top!!

Over the TOP would ask you for 2 levels of membership, to get Auction listings you pay £250 and to be their so called “retained client” you pay £1800, yes £1800!!

You will be made aware of lots of below market value property deals which can earn you or save you money and the aim is to get you on board as a client with positive feedback from (internet) clients you do not know or have any reference of. When you are up for the membership, you will be asked to provide your account or credit or, debit card details. Now be very careful here, sales people will be very fast, enthusiastic and quick enough to want you to confirm or “activate the membership” over the phone the moment you’ve given your financial details.

Remember, once you have paid the “membership” money and activated your account you can never ever claim it back, “better think it’s lost” or stolen if you can live with that 🙂

What are the real benefits in becoming a paid member, none!, Why?

1. Auction properties: You can get them for free from any auction site, it’s simply free.

Call the auctioneers and they will be happy to provide you with the list via email or mail they have to sell their stuff to you and make commission, don’t they.

2. Some will tempt you as their retained client:- If by any chance you decided to become their retained client (where you are promised the listing of property 1st) by parting with £1800, you will be asked to “commit” to the property you have never seen in your life so that can be taken off the market.

The moment you said yes, you are obliged to pay them their 2.5% commission upfront + any deposit required to secure the property (normally 10 percent).

Now who in their right minds would agree to even commit to buy a property not viewed and give the fees upfront, which again cannot be “claimed back” !!

What if the property you bought has major repair works OR

Annoying neighbours, you might need some kind of insurance to protect you for few BMV deals. This could be the reason it was sold at less value in the first place.

Leasehold flats in London unless in high profile areas of Kensington etc are very hard to sell if lease is below 80 years so beware on that too, properties are normally 15-20 percent cheaper already because of this.

So few rules to remember when you are dealing with any company who asks you for membership fees and their commission or any form of payment upfront without the facility of viewing.

Stay away from companies who asks for fees to be their client.

Do not commit to anything over the phone!! In some and you can lose all your money paid!

Only ask for written invoice and then decide should you get tempted for this money loosing “adventure”. Companies have “cooling off” period but if the invoice you receive is later then “cooling off” period?

Do not give your account details over the phone, once gone, they are out of your hand.

Do not pay upfront anything. If they want you as a client they can show you the property and give you a timeframe of 24 hrs to decide to put offer.

Do not commit to or pay their fees upfront to BUY the property, only on exchange of contracts as that might never happen if the vendor decided to back out!

All the above points are only for you to be safe and how to save money in current climate and put it to better use.

You can search about some companies by googling their name and on sites like: moneysavingexpert and singingpig and newspaper site guardian, observer and property-system.

Comments are closed.