Latest output figures suggest construction is sliding into recession

Today’s construction output figures are a bit of a mixed bag suggesting things are getting worse, but that they were not as bad as we thought they were.

The headline figure is that output over the three months to October was down by 1.1% compared with a year ago.

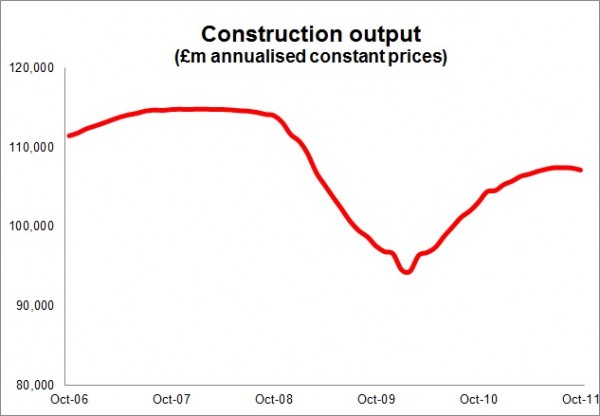

And, as is clear from the graph, on the basis of the latest figures the industry does appear to be subsiding into recession.

And, as is clear from the graph, on the basis of the latest figures the industry does appear to be subsiding into recession.

The graph shows the monthly progression of the past 12 months worth of construction measured in constant 2005 prices. The data before 2010 is estimated from the quarter figures produced.

The main contributors to the recent fall were in the public sector, where new housing, housing repair and maintenance and non-residential new build were all down and the pace of collapse appears to be accelerating.

Countering this fall in public building works was a continued strong performance from infrastructure, where 11.5% more work was done in the three months to October compared with the work done in the same period a year ago.

But the interesting back story to these figures from a statistical point of view centres on the revisions.

Last month there was a pretty substantial upward revision in the figures resulting in part from a tweaking of the process for dealing with late survey results. Adjustments to how the statisticians estimate for missing data are to be expected with a new series such as this.

The adjustments were made, quite properly, to make future revisions more balanced. That is to say some up and some down.

What is perhaps a bit surprising is that the latest data was once again revised upward quite a bit.

The effect has been to produce a picture of a much more buoyant construction sector for the second and third quarter of this year. Growth estimated last month at 2.6% for the second quarter is now thought to be 3.1% and the ONS now estimates that there was 0.3% growth in activity in the third quarter instead of the previously estimated decline of 0.2%.

On the basis of the latest set of revisions, it seems reasonable to assume that future revisions may well tend to be more upward than downward, so the October figure may not prove as dull as it initially seems.