George: It’s time to show confidence in construction, not use it as a political prop

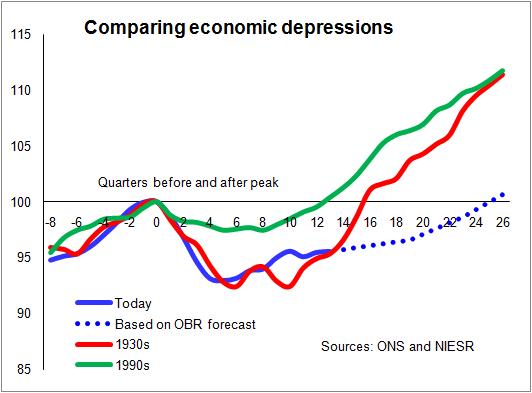

Here’s a graph (below) that probably illustrates as well as you can the economic plight we face.

It compares the depth and length of the current depression (the period when GDP is below the previous peak) with those of the Great Depression of the 1930s and the lesser affair in the 1990s

It shows, based on the latest growth forecast, how on the depression we are living through is likely to last two and a half years longer than the Great Depression.

It shows, based on the latest growth forecast, how on the depression we are living through is likely to last two and a half years longer than the Great Depression.

It’s ugly.

But there is hope and a large part of it can be found within the construction industry.

Yesterday’s spluttering squib of a “budget” for construction was recognition of this, but frankly its offerings were pathetic.

Quite simply the construction industry was used as a backdrop for parading every senior minister around attractive sites in hi-viz jackets, hard hats and wellies in a shameful attempt to make it look as if they were doing something useful.

When I finally gave up trying to make sense of the figures in the Autumn Statement I was left with an anxious hope that construction spending is not in fact actually being cut.

We will see when we get to the bottom of why, in a document that supposedly promoted a great leap forward for UK infrastructure, the already falling public sector capital spending was less in the current forecasts than in March (£16 billion less over six years).

The Autumn Statement and the heavy pre-briefing was a sham.

It was long on promise and short on real commitment.

So how can the construction industry help us out of this economic crisis?

First, here are three observations.

One: It will be years before much-talked-of boost to funding underpinned by pension funds flows freely through the financing channels that feed construction. And the Government looks increasingly like it will be obliged to take on the construction risk to tempt these folk to invest.

Two: These folk are not interested in risky construction. But they may well be interested in owning the fruits of its labour – assets that provide steady and fairly low-risk returns.

Three: The economic crisis is immediate. The earlier we fill the construction funding gap the more value we will derive. Every extra person left unemployed makes the hole we are in deeper and the debt grow faster.

Put simply we need someone to stump up the cash immediately to get things built, which can then be sold when the economy is in better shape and demand has strengthened to the pension funds, housing associations, private investors, households or any other buyer.

It’s a bit optimistic to expect the private sector to stump up all the desired investment for construction projects when cash is tight, risk is high and confidence is rock bottom.

But what are Government’s there for in a modern mixed economy?

Well one big thing is to provide confidence. The second is to provide funding when and where there is a patent need to keep the economy going and when private sector funders lack desire or capacity.

We saw the Government adopt these roles without hesitation when the Banks were threatened.

However, the Government and its opposition feel heavily constrained and are unwilling to spend the kind of money on construction needed to make a difference. The scale is not £5 billion over three years but £50 billion or more over three years.

So why will it not seek to be creative and use the experimental quantitative easing process to fund the construction of built environment assets that in time can be sold on to the private and not-for profit sectors?

Why not let the cautious pension funds buy the gilts and let the Bank of England invest its “newly printed” money in built environment bonds.

Why should the Bank not invest in public interest companies that finance new homes and infrastructure and that are time limited with a remit to sell all their assets?

Are these assets just too risky? If so why would a pension fund wish to invest?

There is little reason to suspect that it would necessarily add to the structural problems of the nation’s debt (indeed the probability is the opposite). It would not freak the markets if the investment is credible and transparent.

Naturally it would all be underwritten by the Treasury putting the risk fairly and squarely on the taxpayers’ shoulders. But the taxpayer would be more than adequately compensated from the reduced benefits paid by the Treasury and the increased taxes that flowed from the work it would generate.

But if the Government really does have confidence that the nation needs better infrastructure and a larger and better housing stock and that the private sector has an appetite to own such assets it should show that confidence and invest.

The result would be a major boost to job creation, a reduction in the nation’s swelling benefits bills, a boost to the nation’s tax take and a long-term improvement in the nation’s infrastructure and housing stock.

So why not be bold George? If ever there was a time to be bold it is now.