Worst orders figures on record suggest the worst on the ground is yet to come

There are times when you hope you’re misreading data or that there may be an error. But it doesn’t look as though these crutches are available as I stare at the carnage implicit in the new orders data.

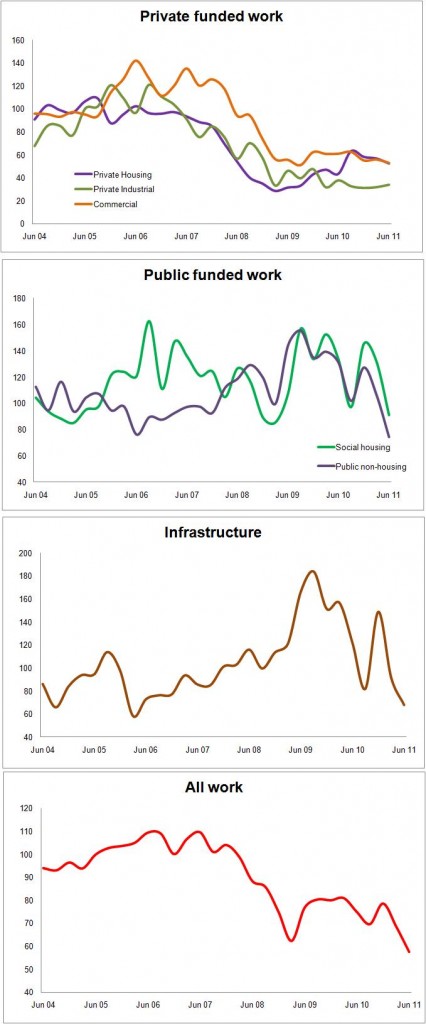

The index, which represents a seasonally-adjusted price-adjusted measure of orders taken by contractors for new work has hit a record low. It stands at 57.5 for the second quarter of this year. Five years ago it stood at almost double that. (see graphs below)

Not since the dark days in the autumn of 1980 – and they were bleak economically – have we seen anything close to this.

Not since the dark days in the autumn of 1980 – and they were bleak economically – have we seen anything close to this.

More worrying is that the direction of travel in the figures appears to be down. The data show a drop of 12.6% in the first quarter of this year and a further fall of 16.3% in quarter two.

Before we get too carried away we must remember that the orders figures are for new work. This represents in output terms a bit more than two-thirds of all measured construction work. Repair and maintenance makes up the other third. Sadly that hasn’t been too perky of late either.

It is also important to note that orders represent work going into the pipeline. How fast it is delivered as output is very variable, so the drop in orders will take time to feed through to less work on the ground.

But all those caveats aside, what the figures appear to be showing is the much-expected collapse in public sector orders is now taking hold.

This was, as I say, expected. The real question was whether the private sector had the oomph to pull the industry back into growth.

Inevitably, as such a huge structural shift in the mix of construction work takes place we would be foolish to expect a smooth transition. A fall in workload was pretty much on the cards.

What however is disturbing is the lack of a sign in the figures of resurgence in the private sector. Frankly the reverse appears to be true.

The two big private sectors delivering housing and commercial work have in recent years accounted for about 60% of all new work orders. These sectors if anything appear to be faltering.

There was always need for caution in reading the housing orders figures – particularly after absorbing upbeat tweets from the housing minister. The uplift in private house building work we saw had much to do with restocking. It would always have taken time for order levels to settle after effort was made to refill the pipeline emptied by the near moratorium on new sites that occurred with the market collapsed.

Similar cautious was necessary too with the much-mentioned bounce back in the commercial sector. This tended to be centred on high-profile London projects that had more to do with global capital than home-grown demand.

It is too early to say that these two sectors will not provide the necessary growth to pull the industry out of recession, but the latest figures suggest the wait for a recovery may be a bit longer.

Meanwhile the hopes that infrastructure spending may contribute to a recovery also look a little jaded. You have to go back almost a decade to see a worse quarterly figure for new orders for infrastructure.

If there is one crumb of comfort in all this – at least for major contractors and suppliers – it is that there is still a stock of work in the pipeline as a result of the big increase in large orders placed in recent years.

The downside of this is that when those big contracts come to an end there will be a much diminished stock of work coming through.

This divergence between big and small contracts may in part lie behind the relatively positive figures produced by the Markit/CIPS construction survey in recent months. But worryingly its latest survey shows a slump in house building and a more downbeat picture generally.

As with all data of the nature of the new orders figures there is room for revisions. Perhaps next quarter the figure will be revised up a little.

But while that may remove the second quarter of 2011 from the history books as the worst quarter on record, it will not expunge the fact that the industry is in distress.