Pre-recession construction industry 7% bigger than we thought – statistically speaking anyway

Lost in the confusion caused by the adding up error made by the ONS in the original release last week of the construction output figures was one rather significant change to the data series.

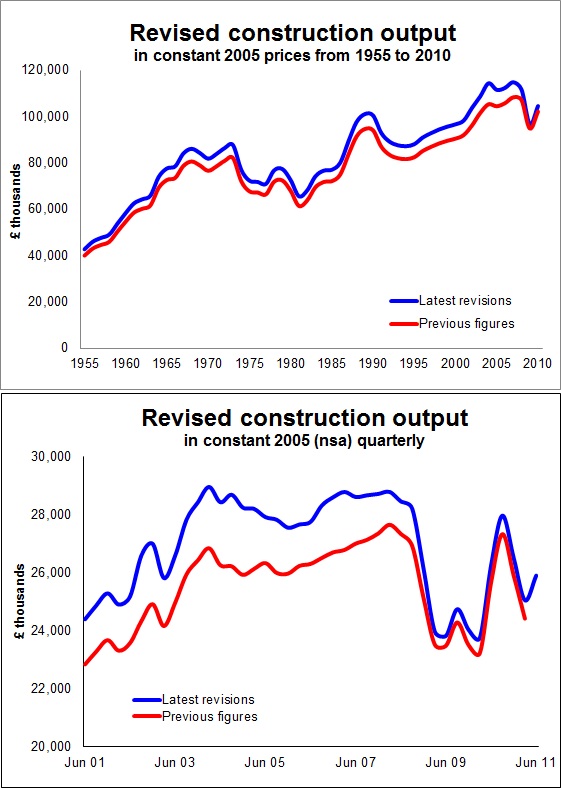

In rough and ready terms the post-recession construction industry is now officially almost 7% bigger than we used to think it was.

Meanwhile, the collapse in construction between early 2008 and early 2010 is now officially calculated to be 16.0% rather than 13.7%.

The new view suggests for instance that construction output in 2004 was £9 billion more than we thought a week ago and in the peak year of 2007 there was £6.5 billion more work done, while in the trough year of 2009 there was £1.8 billion more work done.

The new view suggests for instance that construction output in 2004 was £9 billion more than we thought a week ago and in the peak year of 2007 there was £6.5 billion more work done, while in the trough year of 2009 there was £1.8 billion more work done.

You can see the effect in the first of the two graphs showing today’s officially accepted level of construction compared with the previously accepted level of construction.

So history now looks a bit different than it did a week ago even though nothing in the real world has changed.

This may seem rather pointless and a bit of a stato thing to do, but it does have important implications for how we view where we are today and how we assess the likely future path of construction.

So, for instance, where we had under the old series a level of construction work in 2010 Q3 higher than in 2007 Q3 we now see a slightly more believable relationship.

This change has come about because freed from certain constraints the ONS construction statisticians have been able to recast the back data for construction output to 1955.

The change was planned and is part of the transition from the former quarterly collected data series to the new monthly construction output data series.

There were various changes in how data was collected and processed made at the time, but the ONS was unable to back cast the data as they might have liked. They were constrained by the official GDP figures and were obliged to keep the growth rates for all construction work to what they were in the Blue Book, which details the national accounts.

This created some weird problems, for instance the constant 2005 data for 2005 didn’t actually match the current 2005 data.

That’s all changed. So unconstrained by the Blue Book figures the construction statistician have applied the deflators they are now using to back data and tweaked the way they deal with outliers. And not surprisingly they came up with a different curve.

The fact that the changes have relatively lowered the level of construction work post recession will do something to ease (a little) some of the qualms various people economist have regarding the data series. But that they have inflated the 2010 surge will not.

What struck me was that the revisions seem to have highlighted (see second graph) one of the big mysteries for me, which is how come output fell by 5% between 2004 Q1 and 2005 Q4 when the number of jobs rose 6%?

And more intriguingly, why has repair and maintenance been in decline since 2003?

I’ve written on a number of occasions about my pet theory, which is that the start of this rather unexpected decline in official repair and maintenance output coincides with the influx of Eastern European labour.

An odd coincidence to pick on you might think, but the old method used to include a measure for unrecorded construction work and for this it used labour market data. The problem is that this labour market data is thought to under record foreign workers.

Hence my suspicions. You can explore these suspicions at your leisure in various earlier blogs.

And any lobbying that will lead to research into this I’d welcome, though I suspect the overstretched statisticians at ONS wouldn’t.

Anyway, I’m not sure what the freeing of the Blue Book constraints will do to the stats for other industries. But maybe construction will come out with a slightly bigger share of the official GDP pie giving it that little bit extra political clout. All favours generously accepted at the moment I think.