We need a thorough review of the construction figures new and old

The latest release of construction output data underlines the critical importance of examining the accuracy and timing of the data, both the new series and the old.

Calculations show that even slight variations to the current data can have a profound impact on the message the figures are sending to policy makers and business users.

This is partly because of the high volatility in the construction market and the timing of the severe weather last winter, which brought much of the industry to a standstill.

If current suspicions over the data are correct this may mean policy makers and the industry are being fed a false view of industry activity.

This in turn would be leading to a false view of the state of the economy overall.

The latest figures suggest a nasty collapse in construction in the first quarter of this year after a slightly milder down swing in the final quarter of last year.

The latest figures suggest a nasty collapse in construction in the first quarter of this year after a slightly milder down swing in the final quarter of last year.

That means we are in recession according to the definition of a recession being two consecutive quarters of negative growth.

And there is no doubt that the construction industry is coming off the boil as the effects of the fiscal stimulus wane. It was always going to be pain deferred.

There is one problem, however, with accepting the figures as they stand. Most people in the know seem not to believe them. And I’ve pointed often to the problems over the past couple of years.

I have just been doing some crude sums on the phone with Noble Francis at the Construction Products Association. They come up with some very surprising, possibly disturbing, suggestions.

The implication of this back-of-an-envelope maths is that the shape of UK economic growth is very different from that which has been published.

In very crude terms the sums point to a fall by 1% in 2010 Q4 GDP (rather than the recorded -0.5%) and growth of about 1.1% in 2011 Q1 (rather than the recorded +0.5%).

The sums suggest shaving a little of the official growth rate in the middle quarters of 2010.

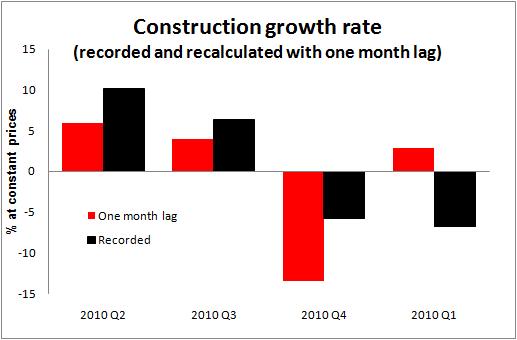

As far as construction is concerned, if we are anywhere near right, it would suggest that construction output rather that falling on a seasonally adjusted basis of 2.7%in 2010 Q1 it falls 10.4% and rather than falling 4.0% in the first quarter of this year it rises 5.6%.

The graph above shows the implications of the sums on the constant price figures.

In doing the sums, what we considered is what would happen if we lagged the data by one month. The reason for this is that we have both shared for some time the concern that there is a lag in the data of possibly between a month and two months (not that we expect the lag to be consistent for each bit of the data).

So January 2011 becomes December 2010 for the purposes of our calculations and so on. We had to make a punt on what the official figure might be on a constant price basis for April. We took a very conservative view of this, taking a figure of £7,500 million, roughly the same figure as is published for last December.

But the lag problem with the data is not the only one being discussed within the industry. There is a perceived problem with the level of output.

And here it is worth saying that it would be unfair to blindly heap all the problems with the construction output series on the current survey. Furthermore blame should not be heaped blindly on the ONS – measuring construction is extremely tricky and they took on a tough job at the worst of all times.

Certainly, if there is a lag effect, it would have existed in the old series as well. But it would have been disguised because the data covered quarters not months.

Also, the new survey, introduced at the start of last year, is constructed differently to the old survey, so the two are not totally compatible. But for the convenience of providing a time series the two are awkwardly spliced together.

This has led in part to the curious result that construction output last year peaked at a level equivalent to the average in 2006, when the industry was struggling for resources.

I have argued many times that there is a strong possibility that the former series greatly underestimated the level of the boom, by anywhere between £5 billion and £10 billion.

If this is the case, repairing that series would allow for a far more informed view of how construction is performing today.

Hopefully this would lead to better policy decisions.

One thought on “We need a thorough review of the construction figures new and old”

You seem to have missed the implications for Q2. If the ONS construction figure for March was matched across Q2 construction activity would rise 10.5% between Q1 & Q2 and add 0.7% growth to the overall Q2 figure.

This is clearly nonsense and highlights further there is a significant problem with the ONS measure of construction output.

Comments are closed.