Do the house building figures really show recovery? Well not really

The latest house building statistics published yesterday tell us practically nothing about the prospects for the industry over the year ahead, other than things don’t appear to be getting worse and that we are still a huge distance from where we were three or four years ago.

Why then does our housing minister Grant Shapps feel the need to pump up the value of what really are still very flaccid figures for housing starts?

He tweeted: “These better house building stats welcome, but this is just the start of the story. Much more to do” and provided this useful link to that well-known house of statistical expertise The Daily Mail.

Its considered opinion was: “Signs of recovery for housing industry after 25 per cent rise in number of new homes started”.

Are there really signs of recovery in these figures?

Let’s put all this in context.

One quarter’s figures without heavy interpretation and rather a lot of educated guessing tell us not a great deal when you have the confusion of unusually bad weather, a major shift in the way house builders are approaching production, the effect of a bounce back after a near shutdown and confusing factors around where and how the Olympic Village will be slotted into the numbers of homes started or built.

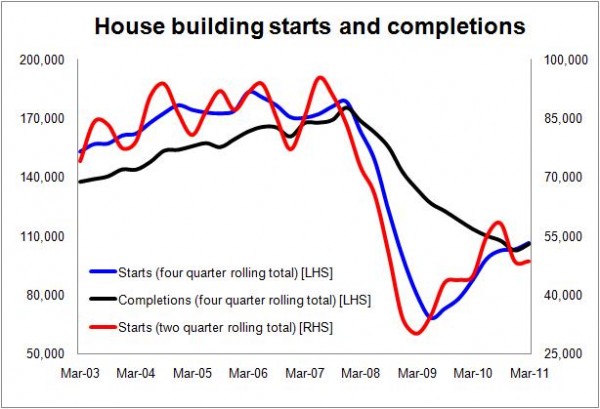

Leaving those problems to one side, let’s take a look at a graph from the non-seasonally adjusted figures produced by the communities department DCLG (see above).

How do you read this graph?

For my money it says a few things.

Yep, starts are on the way up, but from a level that if it were it sustained would have meant a further collapse in completions. On an annualized basis (the blue line) starts are now roughly on a par with completions (the black line) which suggests the building pipeline is getting closer to rebalancing itself – what some might very loosely regard as analogous to restocking.

On a six-month rolling basis (the red line) interestingly the figures hint at a downward correction from a bit of an earlier surge, rather than a surge from an earlier low as suggested by the quarterly figures. But I wouldn’t get too bothered over that. The broad pattern doesn’t point to a fall.

And finally on an annualised basis we see housing completions finally shifting up. Well about time too.

None of this screams “recovery” to me and certainly not when there are so many factors that are clouding the issue.

So I am with Mark Oliver of H+H Celcon on this when he tweeted in response to Mr Shapps’s rather upbeat interpretation of the figures: “Premature on housebuilding surge? Yes CLG Q1 is up 16% on 2010, but NHBC starts for Feb to Apr are down 16%…”

And for those that follow tweets there are further interesting points made by Mr Oliver and Noble Francis of the Construction Products Association on the figures

As many a hardened investors might quip: “Green shoots are for pandas.”

One thought on “Do the house building figures really show recovery? Well not really”

Is it time for the Government to seriously consider providing mortgage guarantee insurance, as in Canada? House building rates will only increase if there is buyer demand which is currently curtailed by the need for a deposit of 25% or more. It must be time for the Government to seriously consider providing mortage guarantee insurance to fund this deposit gap so that more buyers can afford to buy which will drive builders to fulfill the demand. A shortage of homes is a drag on economic growth as employers with job vacancies cannot fill them because would be employees cannot afford to move to where the jobs are. The cost and risk of the Government providing this insurance is low since, as it effectively controls house prices via a monopoly supply of permissioned land, it can hedge its exposure. Furthermore, many economists would argue that the collapse in housebuilding over the past three years has already sealed our fate for rapid house price inflation in the next decade, meaning that the likelihood of mortgage guarantee insurance needing to payout is very low. Seems simple to me….

Comments are closed.