Bad, but the GDP estimate for construction probably overstates the drop

The economy is flatlining – that is the assessment we are encouraged to draw from the first stab at national output by the statisticians at ONS.

The 0.5% growth in the first quarter of this year to counter the 0.5% snow induced fall in 2010 Q4 was very much in line with the consensus view among economists. So it will not come as a surprise.

But the stagnation over the past six months implied by the figures is a blow to the Government’s plan for a recovery. The economy is still running at about 4% below peak, which will bear down heavily on the attempts to reduce the deficit in Government spending.

But the stagnation over the past six months implied by the figures is a blow to the Government’s plan for a recovery. The economy is still running at about 4% below peak, which will bear down heavily on the attempts to reduce the deficit in Government spending.

What’s more worrying, if we delve into various figures delivered today, is that the rebalancing of the economy is looking much shakier than the Government might like. Although in fairness it’s still early days.

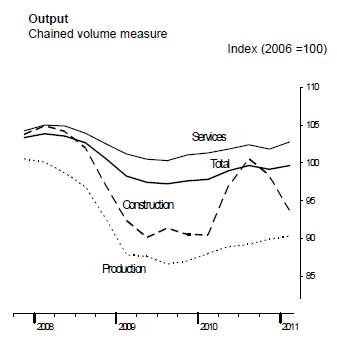

The graph provided with the release (see right) probably tells you much of what you need to know about the shape of the recovery and also construction’s part in it.

It shows how construction played a starring role in lifting the nation out of recession. Now one of the big dead weights holding back growth appears to be the construction industry plunging rapidly back into recession.

Even when the guesstimated effects of the nasty snowfalls this winter are discounted, the official figures show construction output falling for two quarters in succession – technically putting the industry into a third dip in this recessionary cycle.

In the first quarter of this year construction industry output is estimated to have dropped 4.7%, following the drop of 2.3% in the final quarter of 2010. Within the GDP figures construction accounts for 6.3% of the total. But with downswings of this magnitude the impact is pretty hefty, slicing more than 0.4% off national output.

With the full force of spending cuts still to impact on construction, it would be tempting to view these figures with severe concern, not just from an industry perspective but also in relation to the performance of the economy as a whole.

More worrying in the detail of the data is the fact that the services sector was still driving growth in the first quarter. The production industries – on which the Government is keen to build future growth – performed pretty meekly given the lost ground they need to make up.

And the bounce back in the production industries will not be helped by the disruption to motor manufacturing in the wake of the Japanese earthquake.

If we flick to today’s Index of Services release to see what is driving that services growth, we see that Government funded sectors such as education (up 1% on a year ago in February), health and social work (up 4.3% on a year ago in February) are performing pretty soundly and contributing to the service sector growth.

Meanwhile, we are far from seeing the signs of a rapid fall in output from public administration and defence sectors, which we are led to believe are inevitable.

In the light of this, the production industries and other private sector parts of the services sector will most likely have to step up the pace if the much-sought-after rebalancing and healthy recovery is to materialise.

So there is much to fret about.

But to provide some rays of sunshine that may be hidden behind skitting clouds, the construction industry on the ground probably didn’t do as badly in the first quarter as the figures might suggest. Also, the chances are that the figures will be revised up rather than down.

As we have noted regularly in this blog, there are problems with the construction output data. It’s a new series that is settling down and it is a very tricky sector to survey.

So I’d take the construction figures with some caution and suggest they perhaps overstate the gloominess. Not that they wouldn’t be gloomy, even with upward revisions.

Certainly (as we explored in a recent blog) the apparent lag effects in the data collection suggest that this quarter’s data may say more about what happened before the New Year. This would mean that the official figures for the final quarter of last year flatters growth, while this year’s first quarter official figure for growth is suppressed.

And we must also remember that the first quarter estimate in the GDP figures is based on the first two months construction output figures. This too supports the case for an upward revision.

If we look again at the index of services figures we do see some corroborating evidence in that the value added by the machinery rental sector (largely plant hire) has performed better on average in the first two months of this year than in the final three months of last year.

So, if there are significant upward revisions to the construction figures, we may well see a significant upward revision in the GDP figures and a much more jolly interpretation of the nation’s economic prospects provided by the phalanx of much-quoted macro economists.

Mind you that all rather depends on where other sectors of the economy go from here.