Worrying new orders figures, despite 18% quarterly jump

You wouldn’t expect a sharp rise in new orders for construction to be a cause for concern – not in today’s work-starved economy.

But that is just what we have.

On the face of it the 18% jump quarter on quarter in the volume of work in the final three months of last year should be a reason to cheer. More work in the pipeline, yippee.

And I suppose it is not unreasonable to see it that way.

But sadly when you look at where the new work is coming from and the levels of new orders in a historical context glee turns rapidly to nagging doubt.

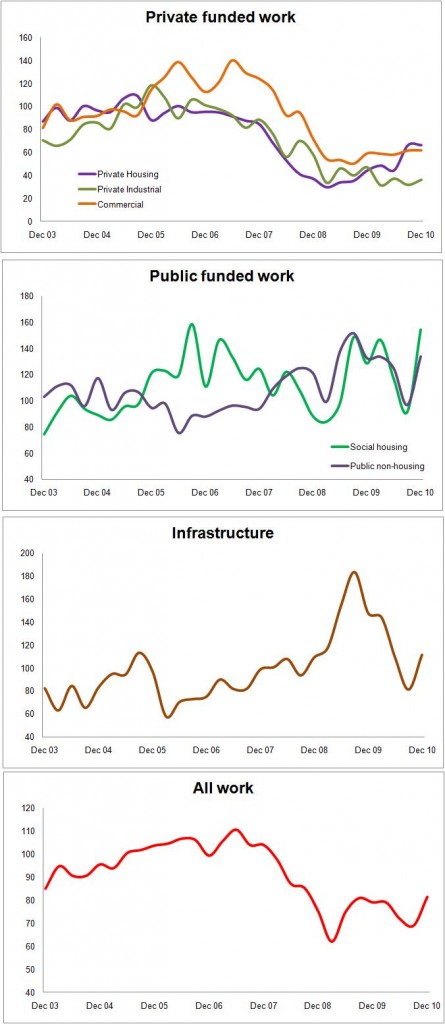

Yes the volume of orders for private sector building work does appear to be growing and is at the highest level since the autumn of 2008. But the level remains at little more than a half of the peak we saw in the spring of 2007 and well below that one might expect is needed to avoid a fresh downturn.

But what really pumped up the volume of new orders was an extreme bounce back in the public sector (as you can see from the graphs below which record the seasonally adjusted volume index).

The obvious explanation for this is that there was a hiatus around the General Election period which has resulted in a backlog of orders being placed later in the year. But that is just top of the head speculation.

Now this rise in work let is good news in the short term and perhaps is one reason why contractors are not currently screaming in abject despair. But it can’t last.

And it reinforces the grim view that any buoyancy in output we may have seen recently is short term.

Real good news for construction would have been to see a rapid leap in private sector work, without that the future looks grim indeed.

Still if you are looking for some good news – as a contractor that is – at least it would appear from the deflators being used by the statisticians that prices for work are thought to be on the up. But then again there are plenty of costs that are rising faster.