RICS housing market survey provides more worries over build rate for homes

The latest survey by the surveyors’ body RICS appears to add as much uncertainty as it does clarity over which way and how fast the housing market is shifting.

The headline figures suggest that house prices fell in January, but at a slower rate that in December.

Is this good news or bad news?

Well optimists might conclude that the market appears to be on the mend, with the pace of decline slowing for three months in a row. But pessimists would say that prices are still falling even if fewer agents are reporting falling prices.

Looking at the entirity of the indicators within the RICS survey it is hard not to fall in line with the pessimists. Agents expect further falls in prices, sales edged down last month, there has been a further reduction in buyers and sellers and the sales to stock ratio has fallen again, which tends to herald falling prices.

But all that said it is probably wise to treat these latest figures with some caution given the rather debilitating weather we endured in December, which will have unsettled the market.

Furthermore the impact of the VAT hike and the public sector cuts are starting to be felt with everyone waiting to see what the full impact on the economy will be. How much this uncertainty about the future path of the economy has influenced confidence within the housing market in the short term is hard to assess.

Perhaps for the construction sector the most worrying data is that showing the continuing fall in both sellers and buyers, even if the decline has slowed.

This reduction in buyers and sellers points to a drop in the number of transactions and this is consistent with the RICS survey finding that the average number of sales per agent has fallen to its lowest level since June 2009.

The effect of reduced transactions in the wider housing market is most likely a fall in the number of new homes sold and in turn fewer will be built.

House builders appear in no mood to cut prices to increase sales. Having refinanced their operations they are eager to rebuild margins so will tend to open sites where activity is most promising and hold off on sites that look unlikely to meet their aspirations.

Given that build rates are pretty much at an all time low for the past 100 years, if you ignore build rates during and immediately after the two world wars, this does not bode well.

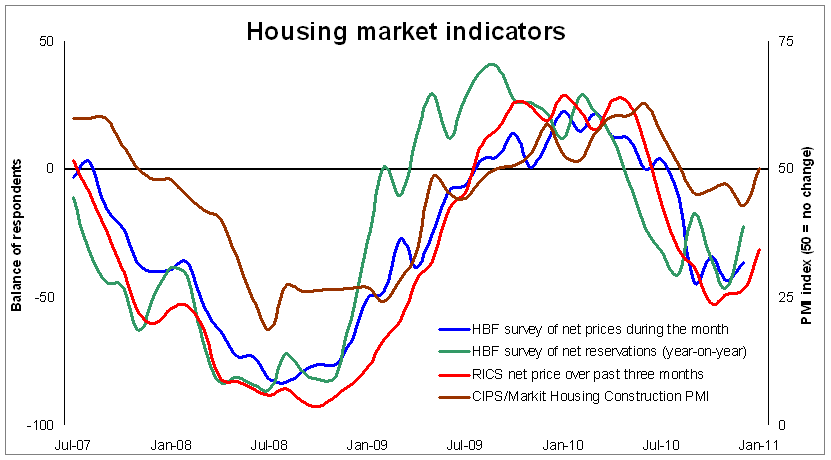

Above, I have put together a graph looking at the RICS house price net balance, figures from the HBF survey on net reservations and its net price balance published in Housing Market Report, plus the housing figures from the CIPS/Markit construction PMI survey.

What we can see is that there is little real room for optimism over growing construction activity in the housing sector for some while. The sweep up in the PMI index (brown line) in January must be viewed in the light of a probably pick up after the nasty December weather.