Warning signs over construction cost inflation

The latest construction survey put together by Markit for the buyers’ professional body CIPS suggested that there are growing signs of substantial increases in the input prices faced by construction companies in the UK.

It reckoned that the rate of inflation was the fastest in seven months and above long-run series average. The survey panellists attributed this to the rise in raw material prices.

I’m not sure how they work out with any great certainty the comparative rate of inflation, given the type of the surveying I believe is used. But I instinctively feel more comfortable with the survey’s take on inflation than, say, the figures presented for activity, which appear to me to track more positively than other data might suggest.

Still, the survey provides an early indicator of change in the industry and in this case a potentially valuable early warning signal.

With the industry likely to be under strain as public sector funding wanes, there is a growing danger of firms under pricing work and later being badly squeezed by rising costs.

Intriguingly, however, the survey once again finds firms on balance in an optimistic mood and – again on balance – they expect activity to increase over the next 12 months.

This seems somewhat paradoxical given the grief we are expecting in the coming months from the projected collapse in public spending.

But one answer may be that the responses on optimism reflect more the respondents view of their firm’s prospects than those of the industry as a whole.

The comment from David Noble, chief executive officer at CIPS, appearing to back this conjecture: “…it is telling that purchasing managers saw the gradual easing of competition as one of the factors contributing to this.”

Those who survive may well do well if lots of firms go to the wall and leave more space in the market.

In fairness to the analysts they do suggest that the positive sentiment is “relatively subdued”. The confidence indicator in this survey has a habit of running very much above what actually happens in the future.

And it is worth noting that, while on balance the sample of firms appears to be optimistic, firms appear to be shedding staff more rapidly, intending to cut yet more staff and a set to use fewer subcontractors. This, one might feel, is not obviously consistent with planning for increased workloads.

Looking at the headline figures for activity the overall drop into negative territory – 49.1 on a scale of zero to 100 with 50 being no change – was hardly a surprise. More surprising perhaps was that the fall was so modest given the appalling weather.

Looking at the headline figures for activity the overall drop into negative territory – 49.1 on a scale of zero to 100 with 50 being no change – was hardly a surprise. More surprising perhaps was that the fall was so modest given the appalling weather.

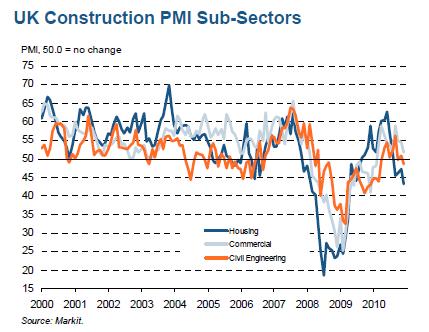

The continuation of the dramatic drop in housing activity will no doubt be snatched upon as a very worrying trend. It is worrying, but perhaps not as much as the graph might suggest.

Some of this slowdown in activity may be an after effect of restocking, the phenomenon whereby there is a surge in the flow of work as firms have to build up stock in the pipeline rapidly having earlier put a stop to new projects.