Forecasters foresee a long road to recovery for construction

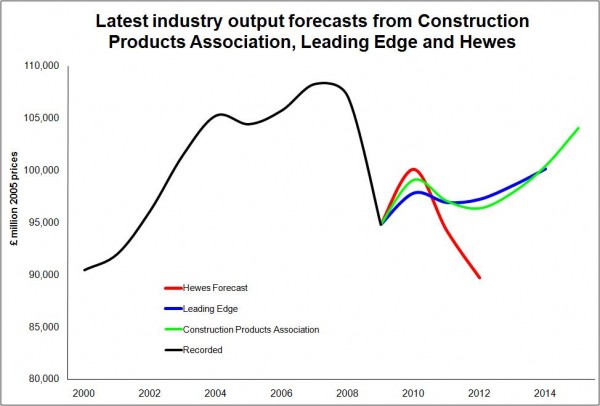

The latest forecast for construction growth to emerge from the Construction Products Association suggests that construction will not see growth of any significance for at least the next two years.

However, while the central projection is for a distinct double-dip in workload, even the most pessimistic scenario presented by the forecasters does not envisage a drop in construction much beyond 5%.

That would be painful but far from as dramatic as the 17% collapse from the peak quarter at the start of 2008 to the depths of the recession in the first quarter of this year.

That said the view is for construction to be chained to negative or very slow growth until 2015 when growth, on the association’s central forecast, will reach 3.6%, which is above trend.

That said the view is for construction to be chained to negative or very slow growth until 2015 when growth, on the association’s central forecast, will reach 3.6%, which is above trend.

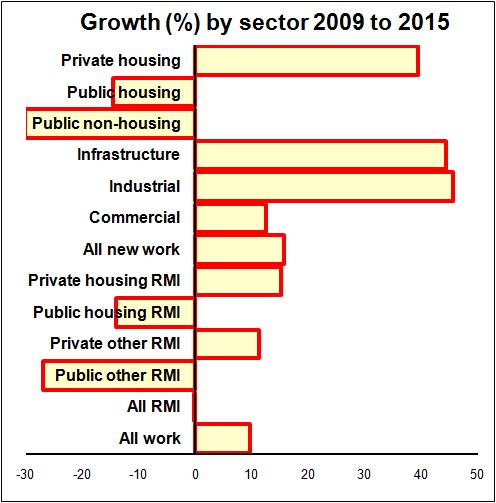

It is new work rather than repair and maintenance that the forecasters expect will drive growth, particularly in the latter stages of the forecast period.

The powerhouse sectors expected to drive growth are seen as the new private housing, commercial building and infrastructure sectors, assisted by a boost from relatively high growth in the relatively small industrial sector.

Not that the forecasters are glum on the level of private sector repair and maintenance work, which they see as growing (at some points strongly) over the next five years, as can be seen from the graph below.

As we see from the graph above the Construction Products Association forecast is more in line with that from Leading Edge than the Hewes forecast.

But, as I have said before, this is a particularly hard time for forecasters as there remain huge uncertainties. The economic turmoil still is far from settled and any nasty twists that might occur could throw these forecasts out substantially.

But, as I have said before, this is a particularly hard time for forecasters as there remain huge uncertainties. The economic turmoil still is far from settled and any nasty twists that might occur could throw these forecasts out substantially.

Meanwhile, it is extremely hard to pinpoint the exact timing and speed at which the private sector will take over from the public sector as the engine for growth. Relatively small differences in timing and rate of growth can have quite substantial implications for the shape of growth from here on.

What we know is that public sector spending on construction will shrink, although whether the planned cuts will in the end be achieved as quickly as the Government hopes is up for question.

What we hope is that the bounce back in the private sector that we have seen in recent quarters will be sustained and of sufficient strength to foster growth overall.

What we don’t know is how exactly such huge cuts in public sector spending will feed through to the private sector and how this might impact on construction.

On balance though it seems fair to assume that the risks, particularly the big risks, are on the downside.