The big question for Mr Shapps

I would like to be among those welcoming Grant Shapps to his new role as housing minister and wishing him well. I must admit I have not been particularly kind to his ideas to date. It’s my job to be critical I guess.

But for the record I do have a degree of admiration for his fervent faith in localism, for which I have much sympathy, albeit with a shed load of doubts.

Somehow it chimes with the anarcho-syndicalist spirit latent within me that wishes to shoo away the peskiness of the state and the grubby fingers of capitalism and let those engaged in the business of doing get on with it.

I strongly believe that idealism should not be crushed but channelled and I, in common with many winners of Miss World I suspect, passionately believe in an end to war, pestilence and famine – frankly a fairer, nicer world.

While I suspect that striving to make localism work will not be as tough as bringing world peace, it will be far from simple or straightforward. My guess is that we might just see more state intervention than the charming policies outlined in Conservatives’ Green Papers “Open Source Planning” and “Strong Foundations” suggest.

All that said, I don’t think that localism is the biggest question Mr Shapps faces.

To my mind the first big question he must settle in his mind is whether he wishes to see house prices rise, fall or remain stable. He must decide whether he believes house prices at current levels are sustainable or not.

If he is to create a coherent policy he must face down this thorny question.

On present evidence the chances of him giving a straight answer on the question look slim. But give him time.

It was enlightening when in the run up to the General Election the BBC’s splendidly clear thinking Mark Easton posed the question to the two would-be housing ministers, Shapps and Sarah Teather, and the incumbent John Healey.

Needless to say not one gave an unambiguous response to the question Easton posed about whether house prices should go up or down. It would seem that ignoring or obfuscating on this question appears to be built into the politics of housing.

Certainly it disturbed me to witness the previous government attempt to build an affordable housing policy without (openly at least) taking a view on the effect of house prices.

Mind you is not just the policy makers who avoid this thorny issue. I have sat through many specialist housing conferences where I have listened to bleeding-heart commentary on the problems of affordability without direct reference being made to the price of housing.

The issue doesn’t so much lurk as an elephant might in the room, it roars like the engines of a jumbo jet on takeoff. But the audiences, highly knowledgeable as they are, somehow managed to ignore it as a fundamental question.

It is rather like being comfortable to talk about poverty without recognition given to the fact that the poor don’t have much money.

Meanwhile the debate is not enhanced by the simple and almost slavish acceptance that high house prices are in some way singularly linked to a shortage of homes. This is bogus. And I say that despite being fervently in favour of building more homes.

Further there is often an unquestioned acceptance of the awkward notion that households form independently of the number of houses.

Perhaps here Mr Shapps might wish to liaise with his colleagues tasked with mending “broken Britain”. He might suggest they seek to make parental breakdown less attractive by making it tougher for the parent leaving the family home to establish a “mirror” home for the affected children.

This presumably would reduce the pressure on housing, while simultaneaously encouraging families to remain together. (God, I should have been a policy wonk with inspirational thinking like that.)

Why should rich feckless parents be allowed easy access to housing when poor stable families struggle to get a foot on the housing ladder?

Okay, just being playful, but you get the point. This is not a simple issue.

Anyway, here’s a few figures worth considering that provide a bit of a challenge to the ready answers given on the housing shortage.

In the short spell between 2000 and 2007 the population of England and Wales increased from 52.140 million to 54.082 million a rise of 3.7%. The rise in people 20 years or more old was 5%.

The number of homes in England and Wales rose during that period from 22.342 million to 24.513 million – that is a rise of 9.7% and an increase in pure numbers greater than in the number of people older than 20 that were estimated to be in the two countries.

In that time house prices in England and Wales, using the CLG figures, rose from £112,457 to £218,011. If we adjust this for inflation using the Treasury’s GDP deflators we have a real price increase of 61.5%.

So despite a drop in the ratio of homes to adults there was a real term rise of two thirds in prices. Does this look like a simple shortage of housing stock problem to you?

(You might note I didn’t say supply, as that opens a whole different set of problems over definitions.)

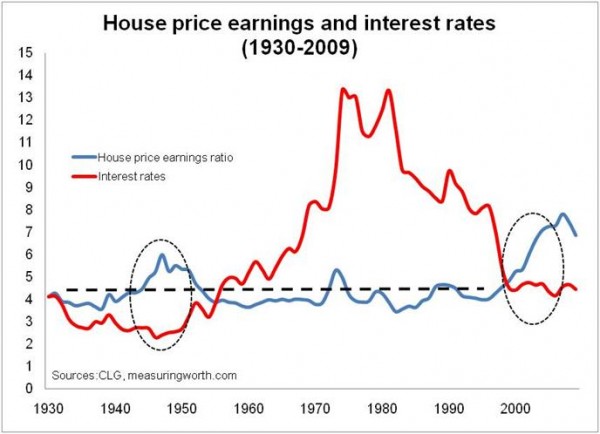

I suspect it might be more fruitful to look more at the prevailing interest rates and the easy availability of funds if we want to understand why house prices are broadly at an historical all-time high.

I suspect it might be more fruitful to look more at the prevailing interest rates and the easy availability of funds if we want to understand why house prices are broadly at an historical all-time high.

That certainly is the suggestion when we look at the graphs.

Here’s one I have prepared earlier, see above, which is up for criticism as they all are. I can imagine some readers getting lathered up about my choice of data here, but for the record I have chosen to use long-term interest rates rather than trying to get a meaningful set of data on mortgage rates.

Clearly teaser rates and other perversions of the natural order of things played their part in the low interest rate environment post 2000, which is understated in this graph. And I am sure that mortgage rates will have drifted well clear of the interest rate levels provide here over the course of the 80 years.

But, after taking all the above into account, what it does seem to show is that the ratio of house prices to earnings was most distant from the long term norm when cash was relatively cheap and/or easier to come by (see the ringed areas). Both periods might arguably also be seen as periods of “shortage”.

More importantly, what policy makers and house builders also need to consider is effect that a sustained period of low interest rates and low wage inflation might have on the numbers of transactions.

From my admittedly crude calculations it is would seem that the ability to move from a first to second home takes twice as long under the current wage inflation and interest rate regime as it did a decade or so ago.

What appears to happen is that higher interest rates combined with higher rates of wage inflation tend to front-end load the “real” repayment on a home with the effect of suppressing absolute values. This provides for a more secure model of equity building, which in turn allows first-time home owners to trade up more quickly.

The implication is that with higher wage inflation and interest rates homeowners will therefore be enabled to trade more frequently, potentially raising transaction rates. Clearly there are other factors at play here related to transaction costs.

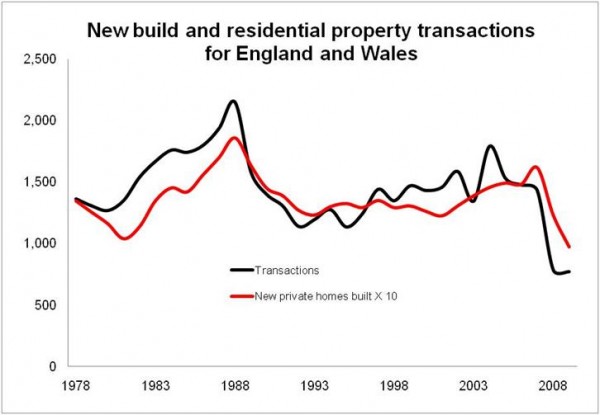

Importantly, a higher level of transactions appears to be central to generating more activity in the private sector.

Importantly, a higher level of transactions appears to be central to generating more activity in the private sector.

There does appear to be a strong link between housing transactions and new private homes completed (or in effect sold).

Don’t ask me why but in the modern context it seems that house builders manage to sell on average about one home for every 10 to 11 homes traded in the market.

Whether there is some direct causal link or they are simply driven by similar factors I am not sure. If there is a link then we need higher transactions if we are to absorb more new homes into the market.

Meanwhile, looking to those currently excluded from the choice of home ownership, suppressing the price of homes would make access easier. This in turn should put less stress on the funding needed to support social housing.

Ah, it all sounds so easy. There is however one big problem. How, assuming you want to, do you realign house prices and earnings.

The past decade or so has witnessed probably the biggest shift in notional wealth from the housing-haves to the housing have-nots. That is a shift in wealth basically from the poorer and younger to the older and richer.

Ironic, you might think, given the hue of the political party in power.

Still, it is politically easy to make people richer, if only notionally. It is much harder to make them relatively poorer, given that rich and poor are in the main part relative terms.

And certainly house builders with long land banks bought on the basis of relatively stable prices would be mightily put out by any sudden drop in house prices.

So I certainly would be surprised to see policies formulated that worked to realign house prices to more historic norms.

Therefore we should expect to see the affordability crisis continue for some while yet, unless of course we see rapidly increasing inflation or the market has some nasty trick up its sleeve.

Anyway, I would be interested to see if Mr Shapps is brave enough to answer “the big question” and I certainly would be delighted if he could give me a steer on the sort of level of house prices relative to earnings he would like to see at the end of this “fixed” five-year parliament.

You have my email Grant…