RICS shows construction emerging from recession, but is it really?

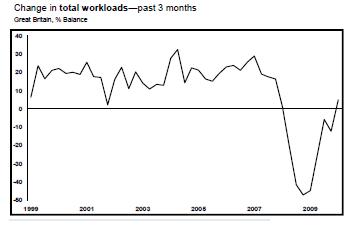

In the current climate it is encouraging to see construction indicators finally point to growth. And so it is good to welcome the return of the RICS construction workload index into positive territory after two years of slump.

Sadly, as is the case with many construction indicators, when they are showing positive results it doesn’t necessarily mean that we are enjoying growth or that growth is coming to construction.

So it is I suspect with the latest construction survey from the RICS, which shows that a positive balance of 5% of surveyors saw more workload than less over the first quarter of last year.

So it is I suspect with the latest construction survey from the RICS, which shows that a positive balance of 5% of surveyors saw more workload than less over the first quarter of last year.

That said the converse can also be true. It is for instance interesting to note that while the official figures had construction rising from recession in the middle of last year the RICS workload index remained submerged below the no-growth line.

However, what lies behind my suspicion that the RICS survey may be currently overplaying the prospects for construction as a whole is the population of it survey sample – surveyors.

The RICS construction survey in more normal times is a pretty good and useful indicator of future workload on the ground, because it is surveying surveyors whose work tends to be biased towards the front end of the construction process.

And as consultants there will always be a proportion of surveyors’ work, like that of architects, that never leads to a finished project. Certainly when the breaks are put on the industry consultants are hit pretty severely, with the more speculative work reduced markedly.

For this reason it is highly likely that a construction recession for consultants proves much sharper than the construction output figures might suggest.

But what is particluarly interesting about the first quarter set of results is that we have had a rather peculiar few months in the run up to the General Election. Consultants have been frantically working in an attempt to get projects ready for sign off before a new incoming Government aimed an axe at capital spending.

How much of this went on is hard to judge, but it will almost certainly have caused a bunching of some kind in workload in the first quarter of this year and so boosted the level of work done.

So it might be better to see the results of the survey in that light and conclude that the upward spike in workload may well be flattering the underlying trend.

On top of this we should also consider the possibility of survivor bias, where those who have survived the recession are now picking up work from those that have not. I am not sure what RICS can do or does to correct for this, but I suspect it is a factor which might be leading to results that overinflate the upside of the recovery.

For all that these are not necessarily bad figures for the industry and there is a long way to go yet before we see the end of recessionary climate in construction.

What is certainly does show, and there is no reason to question this, is that the South is enjoying the best of things with the North still mired in recession.