Private housing completions in England have dropped by more than half since the credit crunch

We all know it’s been bad in house building, but sometimes you have to look at the figures again to remind yourself just how bad things have been.

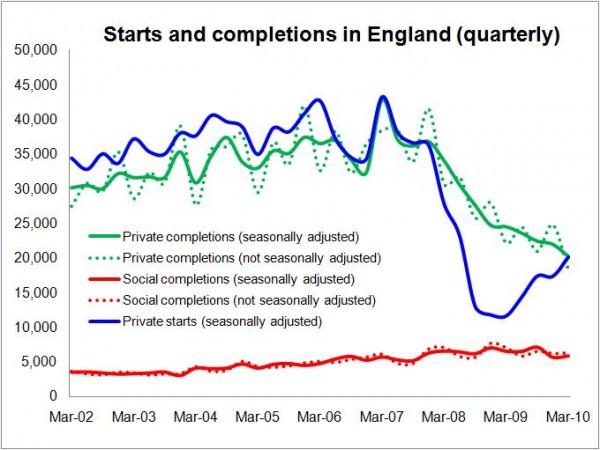

The release of the latest housing figures provides that reality check, as the graph below so clearly illustrates. It’s been carnage and it is a long way back even to meet pre-credit crunch levels of building.

In the first quarter of 2007 the industry was beginning to motor as is clear from the graph showing completions of private homes on a seasonally adjusted basis.

In the first quarter of 2007 the industry was beginning to motor as is clear from the graph showing completions of private homes on a seasonally adjusted basis.

The nervousness that started to infect industry, as rumblings in the financial markets intensified through 2007, is evident.

From then on it was devastation with production dropping from a peak of 41,590 homes (actual) in the final quarter of 2007 to 18,330 in the first quarter just past.

And, yes, while there was some solace in the significant percentage increase in social housing completions, its contribution to overall housing stock was dwarfed by the drop in the private sector.

There is however some encouraging news in the starts figures, which continue to improve. But, as is clear from the graph, we may well be looking at further falls in completions before we see a recovery in the numbers of new homes being delivered into the market.