Latest construction forecasts suggest there is more to fear than hope for

The latest round of forecasting by construction experts paints a picture little changed from three months ago with little hope of significant growth, much uncertainty and the risks to growth heavily weighted on the down side.

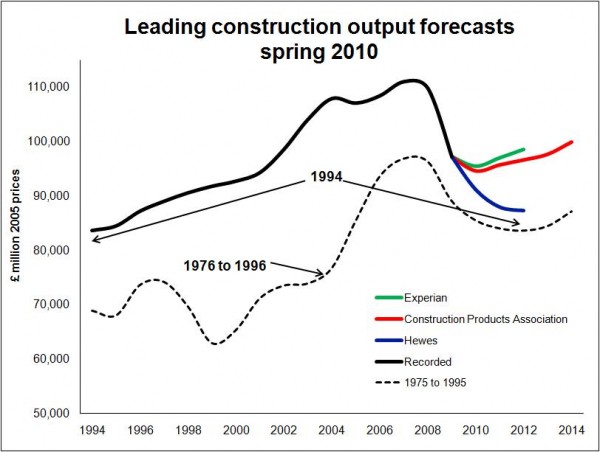

The general pattern they expect can be seen from the graph (right).

The general pattern they expect can be seen from the graph (right).

It shows that after the biggest recorded annual fall since comparable records began in 1955 the forecasters expect a continued slide this year.

There is some variation in views on this, with Hewes rather gloomier than the Experian or Construction Products Association.

But what is very clear is that the forecasters do not expect a bounce back in activity that one might have been expected after such a sharp fall in 2009.

The longer-term projections from the Construction Products Association suggest even by 2014 the pallid rate of growth will have only just lifted the industry’s workload above that achieved in 2002.

The simple reason for this is that the fall would have been much sharper had not the public sector pumped up spending to cover for the near synchronised collapse of the giant private housing and commercial sectors.

Public sector spending is now more important to the future of construction than it has been for decades and accounts for almost half the total new investment as well as a much larger slice of refurbishment than before the credit crunch.

But the path of public spending remains unclear until after the General Election. And here lies the problem for the forecasters, who have little detail to go on until the new government settles on its first Budget.

For instance, sharper cuts in public investment spending – the curtailment of the schools programme for instance – would have quite a profound impact on construction, leaving the industry more reliant on a private sector that looks set for spluttering growth at best.

Or, say, a rise in VAT to 20% – within the realms of possibility – would almost certainly impact badly on private housing repair and maintenance which is both a large sector and is marked down by the Construction Products Association and Experian for growth.

These are but two of the many uncertainties created by the Election. And there are many other fairly sizeable uncertainties that are obscuring the forecasters’ vision of the future – inflation both within the general economy and within commodities, interest rates, fragility within the jobs market, uncertainly over the strength of economic growth.

It is however fair to say that the forecasters’ view of economic growth is rather lower than that presented by the Treasury, so there is a possibility of a surprise on the upside.

For those looking for growth markets, the consensus seems to be that infrastructure and housing offer most room for growth.

In some respects the growth in housing is to be expected given the historically low levels of production currently. An average of the forecasts would suggest a 20% growth in the level of construction output in the sector over the coming three years.

The uplift in infrastructure spending too is also, perhaps, to be expected with economists, other forecasters and industry lobbyists arguing strongly the case for immediate and massive investment in the overstrethched utilities, transport and other infrastructure.

Interestingly the forecasters do not foresee public sector building experiencing deep declines until 2012, which would seem to give those heavily reliant on the public purse some time to reshape their client base.

The real damage in the short term is expect to be in the huge commercial sector where the forecasters expect a drop in volumes of about 20% this year on top of the drop of more than a quarter last year.