Is the housing market on the turn again?

Today’s release by the surveyors’ body RICS of its latest housing market survey provides a little bit of support to both sides of the will-they-won’t-they debate on house price rises.

Looked at nationally, the broad measures of estate agents experiences and expectations of house prices remain positive.

A majority of 17% saw prices rise in February and a majority of 7% expect prices to continue rising.

This will pep up the spirits of those keen to see evidence that prices are rising, after the reports by both Halifax and Nationwide that their price indexes fell in February.

But that really is where the good news ends, unless you take a more parochial view and live in London and the South East, or you are confident that the recent downturn in some house price measures is all a result of heavy snowfalls and the ending of the stamp duty partial holiday.

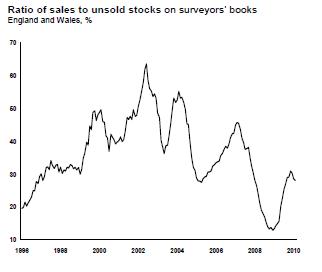

One of the measures within the RICS survey that creates most interest among the more avid housing market watchers is the sales-to-stock ratio (see graph, sourced from the latest RICS survey). This, as we have seen before, has an uncanny knack of heralding shifts in house prices as measured on some indexes.

One of the measures within the RICS survey that creates most interest among the more avid housing market watchers is the sales-to-stock ratio (see graph, sourced from the latest RICS survey). This, as we have seen before, has an uncanny knack of heralding shifts in house prices as measured on some indexes.

The ratio does seem to provide a reasonable indicator of “immediate” supply and demand in the market, given that measuring effective demand in housing is a rather fraught task. So it is reasonable, if the above is true, to assume that changes in this measure would influence transaction prices.

So the fact that this measure is turning down is of note and should be met with some concern, though certainly not worry at this point. The as yet unanswered question is whether this is a temporary blip of a trend.

One point I would make though is that, I suspect, too much weight is placed on and too much attention paid to long-term structural supply shortages when examining short-term price changes. As the previous blog shows, the notion of a “housing shortage” is far from cut and dried, however much we all may believe it to exist or define it as existing.

Imagine if you will the impact of a doubling in mortgage rates. This would keep rates well within what historically has been accepted as “normal”. But the stress this would put on struggling mortgage payers would be tremendous and almost inevitably lead to a surge in the number of houses on the market.

In a market where buyers remain relatively rare and limited to those with cash, the effect would almost inevitably be a sudden sharp reduction in prices. No structural long-term shortage would stop that.

I must admit to a smile when I read this comment on a note from Capital Economics written by the consultant’s chief property economist Ed Stansfield: “We are not convinced that the recent recovery is evidence that long-term supply shortages are underpinning UK house prices.”

I was rather surprised by the timidity, given its source. To my mind, what we are seeing now is a complex interplay of extraordinary factors that has created a short-term supply and demand imbalance in favour of sellers. So a rise in the price indexes is not that surprising.

But one of the results of the weird circumstances we are current witnessing is the “de-lamination”, if you like, of the market structure, as the market segments dominated by the cash rich and low loan-to-value buyers separate from the rest.

This makes any aggregate-based analysis of the whole market both difficult and suspect.

Indeed, a report out today from Rightmove provides further evidence of the dwindling impact first-time buyers have within the housing market, which is disturbing the “natural order” of things.

I would be extremely cautious about putting too much emphasis on any house price index in the current market.

For those in the construction industry, however, it is important to remember that there is no strong correlation between house prices and house building.

The steady and strong rises in house prices from the mid 1990s did not generate a massive upswing in production.

But there is a link between house price changes and the production of new homes, albeit less than straightforward. The complexity can be in part seen by considering that high house prices can exclude potential customers from the market, but falls in prices can quickly make some schemes unprofitable to develop.

What’s most helpful for creating an environment conducive to house building is a reasonable degree of stability and confidence. The sooner we get to that point the better.

One thought on “Is the housing market on the turn again?”

Being an Estate Agent in East London, it is evident to date that sales will have decreased slighlty in March from Febuary as affordability hasnt changed yet prices have gone up.

Comments are closed.