Residential planning activity bounces back

The latest Government planning data on the face of it supports the view that there has been a bounce in activity within the house building sector.

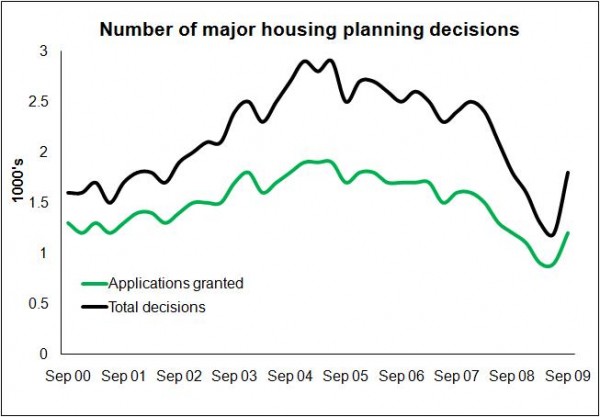

The topline data, released today, for residential planning decision show a fall in the September quarter compared with both the previous quarter and on the same quarter last year.

But the figures for major developments (10 or more units) are on the rise and it is within these developments that the meat of house building activity takes place (see graph).

But the figures for major developments (10 or more units) are on the rise and it is within these developments that the meat of house building activity takes place (see graph).

Before getting too excited though, what these figures don’t tell us is how many of the planning decisions are being made for new applications where consent already existed.

Certainly, analysis I did earlier this year for the Housing Market Intelligence report using Barbour ABI planning data does suggest that house builders are re-planning increasing numbers of their sites to meet the radically changed pattern of demand for homes.

In crude terms there is a low demand for flats and a higher demand for family houses. But large swathes of the consented land have permissions for flats rather than houses. This will be tempting house builders, where it makes commercial sense, to put in new applications to switch consents from flats to houses.

So if reapplications are, as I suspect, partly responsible for the upswing in consents, it means that landbanks are not increasing as fast as the bald data might suggest. But it would mean that starts on site are more likely.

Interestingly house builders are getting very twitchy again about planning delays. The latest Housing Market Report survey data shows that increasing numbers of builders see planning delays as a major constraint on their business activities.

The number of house builders citing planning delays as a major constraint sank from 90% in September 2007 to just 32% last December. The figure however has risen to 60%.

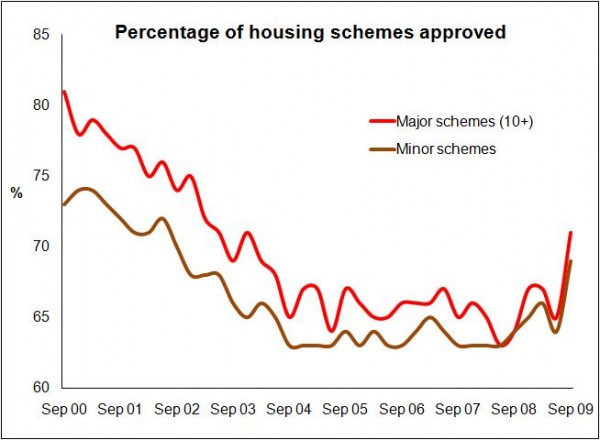

Ironically, planning applications appear from the official figure (see graph) to be more likely to go through than at any stage since 2003 and there is no sign that decisions are any slower. So if anything the planning process appears to have improved from the perspective of the house builder.

Ironically, planning applications appear from the official figure (see graph) to be more likely to go through than at any stage since 2003 and there is no sign that decisions are any slower. So if anything the planning process appears to have improved from the perspective of the house builder.

This rather suggests that planning has once again shot up the boardroom agenda at house builders, which might seem rather strange, given that at current rates of build many have landbanks sufficient to cover eight or nine years into the future – twice the levels they would have carried in the past.

It may just be that their rediscovered frustration with the planning process is further evidence that they feel the need to rapidly re-plan large slices of their already consented land.