RICS survey heralds a Happy New Year. But the industry needs many happy years to regenerate

There are times when you can and should quibble over the direction of travel suggested by business surveys and nitpick over the data and methodologies. There are times when it’s pointless.

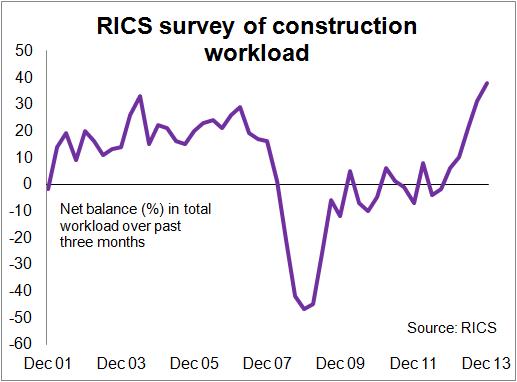

This is one. There’s little doubt from the findings of the latest RICS UK Construction Market Survey. The graph rather says it all. The industry is growing strongly.

That taken as given, there still remain pertinent questions and certainly there are nuances within the results that should be considered.

That taken as given, there still remain pertinent questions and certainly there are nuances within the results that should be considered.

Is the growth as strong as the survey seems to suggest? What’s really driving growth? And where is this recovery in activity taking us?

Before considering those questions it’s worth noting that later today (or probably already, if you’re reading this after 9:30 on Friday) we should see the latest construction output figures.

They will probably show more growth (we hope). And, if the RICS survey is representative of what is happening on the ground, then we will see signs of potential improvement – if not some growth – across most if not all sectors.

Were the regional output data for each sector taken from actual samples, as opposed to modelled from orders data, we might confidently expect – on the basis of the RICS survey – to see a spread of growth occurring across the regions. We still may.

A wide geographic and sector spread of growth certainly is the picture painted by the RICS survey. The spectacularly high reading we see for the final quarter of 2013 is likely to be in large part down to the recovery being so widely based.

Then again there may have been the influence of Christmas spirit in the mix – the final quarter figures for the survey have been over the past dozen years a bit more erratic than other quarters.

Jesting aside, surveys of this type can lean towards emphasising the breadth of recovery more than the depth. A lot of people having a slightly better time can provide a much stronger reading than a few people having a much better time.

There is another point worth noting about the RICS survey – a good thing from a contractor’s point of view. The mix of respondents to the survey tends to be a bit ahead of the action on the ground. So what we see in this survey is probably a foretaste of what will show in the construction output figures.

The comments above probably in part answer the first question. The growth is broad, but not necessarily as deep as the survey might suggest. It could be, but we really need to look elsewhere to gain a better view.

As to what is driving growth, the answer here can I suspect be gleaned in part from the fact that all sectors and all regions appear to be enjoying growth. So it points to the economy overall.

Yes the private housing market in the South East was an early catalyst stimulating growth but the increase in activity is now widespread.

Call me a cynic, but the Election less than 18 months away may be part of the underlying reason for a rather more benign economic environment. The Chancellor seems to have managed at best pitiful results rebalancing the economy, but the last thing he would want to lay before voters is poor economic growth. Here he has power, at least in the shorter to medium term.

There are many well-regarded economists who suggest that austerity was in fact put on hold in 2013, as Simon Wren-Lewis, economics professor at Oxford University argues here.

We also have a very potent and very contentious policy – Help to Buy – in place along with the Funding for Lending Scheme and super-low interest rates. These will all help stimulate construction growth. But while it’s a nice feeling while it lasts, the problem is how long will the effect of the stimulants last and what happens when they are withdrawn?

One good thing about how the construction recovery is shaping up is that it finally seems to be broadening out. That’s a good thing. After years of harsh times the supply base is tired and tattered. So it is better that the recovery is more gentle and spread wider rather than very rapid and narrowly focused. A wider recovery means the supply base as a whole has incentive to rebuild and hopefully points of high stress are less likely.

Rapid growth – if the growth is as fast as some suggest and the official data hint at – may actually hinder the deep healing the industry so much needs.

Frustrated contractors will not wait patiently for their local or regular suppliers if they are unable to deliver. Buyers will become promiscuous as they stretch every sinew to meet their commitments.

A steady path to rebuilding training of youngsters may become overlooked as job agencies in Eastern Europe and elsewhere are reopened to feed contractors desperately seeking skilled workers.

So there’s a danger that supply-chain relationships may be further damaged and the scars left by the recession will be left untended.

Ideally, the industry needs a Tardis in which to place key politicians instructed to go back a few years and do what they should have done then: invest more heavily in construction during the downturn. This would have preserved the supply base and made damn good sense as I have long argued.

Because while this is certainly a much happier New Year for construction, which makes for a pleasant change, the challenge for the industry and its leaders is almost as tricky – to ensure that growth (and the industry) remains sustainable.

I know sustainability sounds a bit “last decade”. But it remains important.