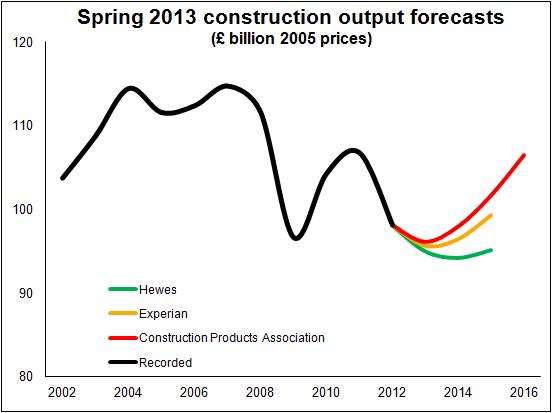

Construction forecasts shaded up, but still predict recession dragging on into 2014

The main industry forecasters have revised up their expectations for the future path of construction output.

The revisions from the previous forecast three months or so ago suggest there will be an extra one billion or so pounds worth of work flowing into construction this year than previously expected.

Part of this is statistical, as the latest Office for National Statistics data puts the fall in 2012 at less than first thought. But, even so, the forecasters have slightly shaded up the rate of growth for the coming year.

Part of this is statistical, as the latest Office for National Statistics data puts the fall in 2012 at less than first thought. But, even so, the forecasters have slightly shaded up the rate of growth for the coming year.

The reasons for the slightly greater optimism differ. Experian believes that recent changes in sentiment within the Government will mean the cuts to public capital expenditure will be less severe than originally planned.

The Construction Product Association and Hewes, meanwhile, believe that the Help to Buy scheme should provide a bit of a boost to private sector housing.

The Construction Products Association already had pretty bullish growth for private housing, but has raised its expectations for growth in the sector for both 2014 and 2015 by a about a percentage point.

The impact on Hewes forecast is more profound, partly because the previous forecast for private housing was pretty gloomy. The latest forecast for private housing suggests pretty robust growth (although less than the Construction Products Association expects) resulting in an expansion of about 14% over the coming three years. Within the Hewes forecast the sector positively sparkles in comparison to the gloomy prospects predicted for most other sectors.

However, before getting too excited about the upward revisions it is worth noting two things.

The risks still remain heavily on the down side and these forecasts were set before the latest release of construction output data. While no one would be silly enough to recast a forecast on the basis of one month’s data, the February figures were pretty horrible and if March’s data is equally as uninspiring then these forecasts could start to look more than a little optimistic.

Overall the forecasts are more aligned than they have been for a while. The consensus seems to put the fall this year in output at somewhere between 2% and 3%. Hewes expects output to fall again slightly in 2014, while Experian expects slight growth and the Construction Products Association is suggesting growth of near 2%.

All expect construction output to grow by 2015. This broadly suggests a turning point in activity in 2014, with Construction Products Association expecting it to be in the first half of the year and Hewes at the end.

If I am honest these forecasts were more bullish than I had expected. But that may be that I am mentally factoring in more of the downside risks.