Why job shedding in the UK construction industry may be about to accelerate

UK construction industry employed about 57,000 fewer people in the third quarter of this year than a year earlier. That’s a drop of about 2.6%.

The ONS data shows that since the peak in September 2007 the fall in the number employed is closer to 380,000. This represents broadly a 15% drop in the workforce.

It’s worth noting that these figures are subject to a lot of statistical noise so a few thousand here or there is pretty meaningless. Furthermore construction employment actually rose slightly in the September quarter to 2.17 million. But employment tends to rise in that quarter, unless the industry has plunge rapidly into recession.

It’s worth noting that these figures are subject to a lot of statistical noise so a few thousand here or there is pretty meaningless. Furthermore construction employment actually rose slightly in the September quarter to 2.17 million. But employment tends to rise in that quarter, unless the industry has plunge rapidly into recession.

But the year-on-year fall should come as no surprise. Construction workloads are declining fairly fast so a drop in the workforce should be expected.

What is perhaps a little surprising is that the redundancy rates in the third quarter were lower than at any time since the recession began and the number unemployed whose last job was construction is falling.

That said the number of long-term unemployed former construction workers remains stubbornly high, although nowhere near the levels seen in the 1990s. This is understandable in a recession where we are seeing a structural shift geographically in where the work is and isn’t.

So overall the employment statistics for construction don’t appear too alarming given the collapse in workloads we have seen recently. That seems to provide comfort.

However, complacency at this point may be a mistake.

Ok we started to see construction output rapidly deteriotate at the start of the year. But there tends to be a delay in the impact on levels of employment from drops in output. The statistics suggest this may be about six to nine months, but there will be variation in this as firms responses will be governed by levels of expectation and confidence as well as what is happening on the ground.

So it is quite possible that we would not yet have seen in the figures an employment response to the drop in output.

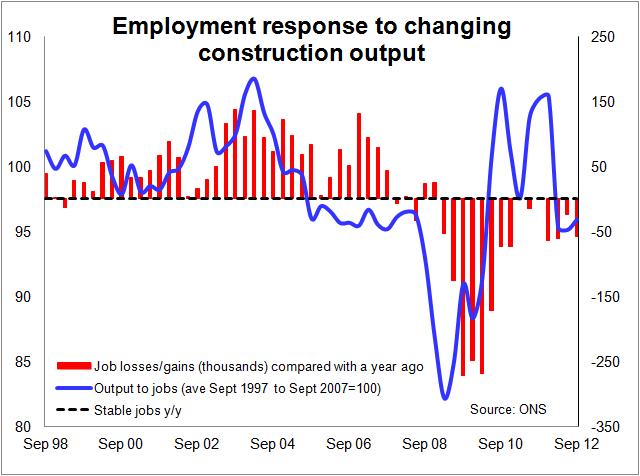

Anyway, to get a feel for where we are I have put together a chart showing the level of output per job and tracked that against the change in the number of jobs compared with a year ago.

The index for the output to jobs is not particularly important, but is based on the average from September 1997 to September 2007.

What we see is that as the ratio of output to jobs falls below a certain level employment levels take a hit. This is not surprising. It simply reflects the need for firms to maintain levels of productivity.

[It’s worth noting at this point that there are different labour requirements for different types of construction work. So a changing mix in the workload will influence these figures, but we will put that to one side.]

We recently have seen moderate levels of job losses (relative to the previous year) as construction firms have responded to drops in workload. But, despite these job cuts, the ratio of output to jobs has fallen over the past year or so and appears to be at what might be regarded as a critical level. This suggests the fall in jobs has not kept pace with the fall in output.

Indeed output in the third quarter of this year was down more than 11% against the same period a year ago. The equivalent drop in employment was 2.6%.

There are two things that worry me here. Firstly the pace of decline of construction is increasing and secondly that there is a delay in the impact that we are yet to feel.

It is not a foregone certainty that we will see an increase in construction job losses in coming quarters. But if we start to see job losses in construction rack up it should not come as a shock.

More importantly policy makers should not be complacent about the construction employment levels they currently see in the ONS data.