Rather than provide growth, private sector new construction has gone into reverse

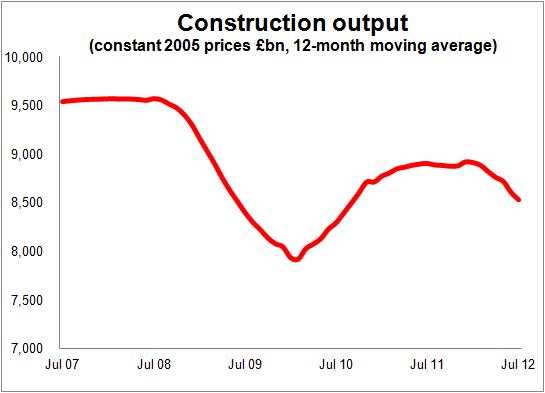

The construction industry is about 10% smaller than it was a year ago on a quarter-to-quarter comparison and it has been shrinking at almost £1 billion a month recently.

That’s pretty scary stuff. It should be scaring the pants off the policy makers.

I’ll admit, I have picked my stats for shock value.

And the graph too perhaps exaggerates the impact of the downturn by starting at £7 billion rather than zero. But I like to think it illustrates the turning point for construction, showing as it does the 12-month moving average of construction output volumes.

And the graph too perhaps exaggerates the impact of the downturn by starting at £7 billion rather than zero. But I like to think it illustrates the turning point for construction, showing as it does the 12-month moving average of construction output volumes.

Anyway, however you look at these numbers, as far as we can tell, things are very bad.

Still, now while I have you in a concerned frame of mind, I want to tell you why I think the reality could be worse than the picture these figures might immediately suggest to some.

For me the most disturbing feature of today’s release on construction output from the Office for National Statistics is the decline in private sector new work. On a 12-month moving basis private new work in commercial, housing and industrial combined has declined steadily since the start of the year.

This hasn’t been helped by some revisions to the private commercial sector. This in effect resized the sector making it about £500 million smaller than we thought it was a month ago.

Revisions like this happen as the data is constantly scrutinised. The revisions can make the figures look better or worse. They don’t however change reality, just our perception of it.

The industry needs to see a flourishing private sector if it is to find enough work to compensate for the savage public sector cuts that will rip out billions in annual output over the next few years.

But on the basis of today’s figures new work in the private sector appears to be heading into recession, rather than growing. And the commercial sector revisions have just underlined the problem.

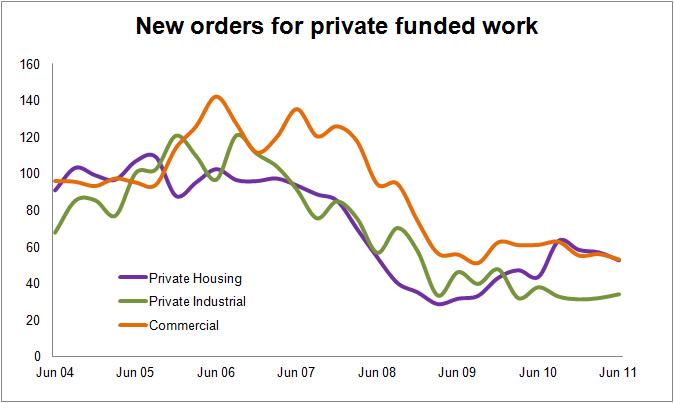

Looking ahead through the viewfinder of the new orders figures makes that picture even scarier, as we considered last month (see graph right).

Looking ahead through the viewfinder of the new orders figures makes that picture even scarier, as we considered last month (see graph right).

Both the level and direction of the private sector orders fails to encourage. There is no discernible growth and the level is at about half that seen before the credit crunch.

There is little point in trying to look on the bright side here and hope it will all get better. That is rather akin to hoping the driver of the oncoming train will spot you when you are stood squarely between the tracks.

Yes there are bright spots. Yes there are opportunities. But from a national perspective the Government needs to recognise that the construction industry will continue to drag GDP downward rather than help boost growth, unless it acts swiftly and effectively.

Ultimately one thing drives construction – demand. Either the industry must act to generate areas of growth and demand, through innovative thinking, or the Government must find ways. Demand for construction is unlikely to result from the wider economy during a period of low growth such as the one we seem trapped in. That is not surprising.

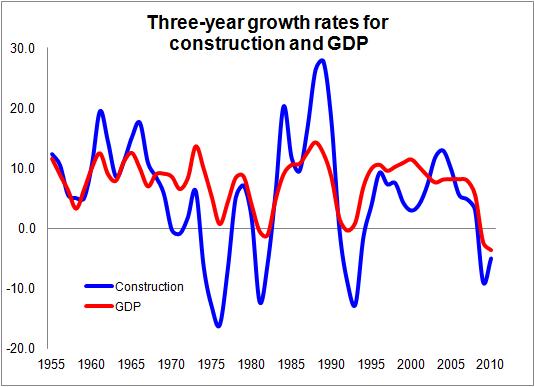

Let me illustrate the history with a graph (see right) I have used before. The graph shows growth rates over three years rather than the customary one year. What we see is that when GDP growth is low for any length of time construction suffers badly. Were I to run this graph with private sector new construction the dips and troughs would be more extreme, but I won’t because the data becomes much less reliable over longish time frame.

Let me illustrate the history with a graph (see right) I have used before. The graph shows growth rates over three years rather than the customary one year. What we see is that when GDP growth is low for any length of time construction suffers badly. Were I to run this graph with private sector new construction the dips and troughs would be more extreme, but I won’t because the data becomes much less reliable over longish time frame.

Unless we see a swift improvement in the underlying economy or we see a reversal of historic trends, it seems unlikely to me that construction will respond as many hope it will without some kind of intervention.

To put it bluntly, as far as we can see into the future, things look pretty bleak for construction if the economy remains flat.

Time for a construction centred growth strategy, maybe.

2 thoughts on “Rather than provide growth, private sector new construction has gone into reverse”

Brian

These are national figures, and I can see good data from the ONS in their July 2012 release

But where do I find regional distinctions?

If the ONS is to be believed, and I am to believe the Economist on http://t.co/daCqFbhG it would mean that the South is doing rather better:

“Construction has weakened everywhere since the beginning of the recession, but in northern cities it has collapsed. In Liverpool, net building has fallen by 85% since 2007; in Manchester, it is down by 90%.”

However I think the Economist must be exaggerating. It is bad, generally, but not so bad even in the North West.

Since I am finding it hard to get back into work, I don’t want to have a distorted view of the dire situation.

Regards

Ian

It is all good us having a construction based strategy, but the government is going to need to make sure that the buildings can be bought and used once they are completed. No point building a new industrial estate if no one is going to buy any of the units

Comments are closed.