What if ONS reports a construction collapse tomorrow?

Tomorrow we get the first hint of how construction might perform this year when the Gross Domestic Product preliminary estimate figures for the first quarter are released.

Looking at the initial data on construction output for this year, I suggest everyone should be prepared for a nasty number to emerge within the data for construction’s contribution.

But while I think it likely, that doesn’t mean it will.

There are things we don’t know. What will early returns for March show? Will March see its normal spike this year? How will the data be treated – the leap day in February for instance? Have the deflators been revisited? What impact will revisions have?

Frankly you can look at the data as it stands and argue a case for a quarter-on-quarter change anywhere from flat to -10%. You could even argue a case for an increase in the first quarter.

The reality is that whatever the figure published tomorrow, expected or unexpected, it is essential that policymakers look through that number and at the broader picture.

A detached approach may not prove easy if construction does dive in the first quarter.

The industry would be right back in recession and might easily drag the UK as a whole into a technical recession.

That would be a big political story. It would knock the currently much-knocked Government some more.

The construction and the official construction data would be right back into the spotlight.

There are upsides. Construction’s plight might get a bit more sympathy.

But there are downsides. The debate might focus on the data and not the on-the-ground problems.

The official data series is new. It has its problems. I’ve been critical. But all construction indicators have problems.

Frankly measuring the agglomeration of industries that constitutes construction and that produces such a multiplicity of product is a hellish task, made tougher by the huge volatility within the sector at present.

It certainly would not help if commentators, economists and policymakers started to adopt a “pick-your-own” dataset approach.

Given the possibility of a sudden drop in output in the first quarter, it may seem ironic that the main industry forecasters have all recently shaded up their expectations for the year ahead.

The latest forecast released was from the Construction Products Association. It raised its forecast for this year from -5.2% to – 2.9%, although rather than seeing a rise next year of 0.4%, as it did three months ago, it now expects no growth.

Broadly the association is much less gloomy than it was three months ago about new build work, where it sees a bit better performance in housing and a less-worse performance in the public sector.

Broadly the association is much less gloomy than it was three months ago about new build work, where it sees a bit better performance in housing and a less-worse performance in the public sector.

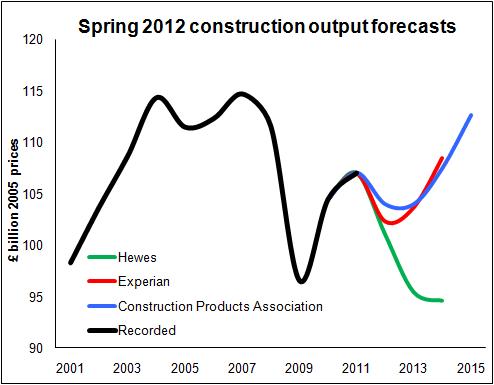

Earlier this month we saw similar changes to other industry forecasts. Experian revised its forecast from -5.6% to -4.4%, while Hewes saw a case to reduce the fall from -6.5% to -5.6%. Both also revised their figures upward for 2013 and 2014.

The graph shows how the forecasts compare. A previous blog covers some of the differences.

The key point to draw from them is the expected fall back into recession and a possible recovery towards the end of 2013. The Hewes forecast is much gloomier and this reflects the huge uncertainties.

How then do these forecasts square with the possibility of a large drop in construction in the first quarter?

Well the first big question tomorrow might well be whether to believe the official data from the Office for National Statistics. The ONS has come in for some hefty stick over the construction numbers.

Meanwhile there have been other indicators suggesting that construction is doing ok. Indeed the Markit/CIPS survey has been very bullish of late, some of which I suspect may be survivor bias, optimism bias or southern bias. Others portray a much bleaker picture, which I suspect is partly down to the particular sector being aggressively squeezed. And many seem to have wavered between upbeat and downbeat over recent quarters.

In construction it is tricky to rely on one indicator. The industry only seems to make sense if you look at the whole range of available numbers. Most indicators have a bias. Given the nature of the industry that is hard to avoid.

It would be wrong to dismiss the ONS data. It is essential to the industry as it is the only source of data that provide us with the scale of the industry as well as its growth rate – a daunting task. And rather than dismiss the ONS data out of hand it is worth looking at explanations for quirky figures in the real world.

There are many possible explanations for why construction might plunge in the first quarter rather more than expected.

It has been far more volatile in the four years since the start of the recession than it was in the four years before, by some margin.

Furthermore we are seeing a shift in workload from public to private sector. This will not be a smooth transition.

The latest data suggest that the drop in public sector work is gaining pace. It could well be that a drop in the first quarter is due to the rapid collapse in straight public sector work. The latest figures for January and February suggest there was 12.5% less traditional public-sector building work done than in the same period a year earlier. (This drop will however probably be revised up slightly.)

Meanwhile the effect on the ground of the surge of large projects let a few years ago is petering out and it will take time for the next set of big projects to wind up. Here we also need to be cautious and take a view that covers the rest of the UK as well as London.

So there are good reasons to suspect a sudden sharp drop in output in the first quarter of this year.

It may happen. It may not.

Either way the danger is that too much or too little will be read into the meaning.