No sign in the data that construction employment is plunging again – not yet anyway

There is no getting away from the fact that the latest UK jobs figures are depressing. There’ll be plenty of discussion about that in the general news. And it bodes ill for the economy overall and in turn for construction.

But for those looking for gloom in the construction jobs figures, the data does not seem to support the view that employment levels are once again plunging.

The quarterly workforce jobs figures were not updated this month. But the alternative Labour Force Survey data were.

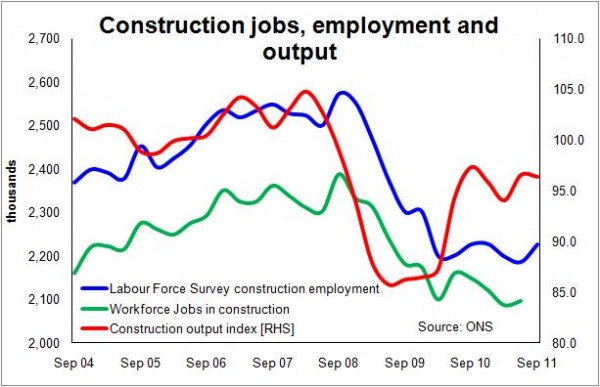

Both sets of data, once you take into account the reliability of the survey, have pointed to a fairly stable level of employment in construction since the start of 2010.

Both sets of data, once you take into account the reliability of the survey, have pointed to a fairly stable level of employment in construction since the start of 2010.

The LFS data suggest employment of just above 2.2 million, compared with a peak level of 2.57 million. The workforce jobs data broadly puts the number of jobs at 2.1 million against a peak of 2.37 million.

If you are that way minded you could find a hint in the workforce jobs figures that the number of jobs is sliding of late. But looked at across the piece with the uncertainty inherent in the data there is no clear evidence of a significant slide in workforce jobs.

What is interesting about the latest update in the LFS data is that the figure for construction employees is up not down. On this measure the industry has the same number of jobs now as it had a year ago – spookily exactly the same.

This is no reason for cheer. But it is reason for some comfort that probably the construction jobs market has been holding up better than many have feared.

Looking at the graph does appear to highlight one issue of concern with the data, the amount of growth in output compared with the flatlining in jobs and employment.

For convenience I have put the lines on different scales, so some caution is needed in reading the graph. But even so, the figures do throw up questions about the level of work being recorded by the Office for National Statistics, given that jobs have been stable since the start of 2010 and output has grown by more than 10%.

Before getting too carried away with the argument, a large part of the explanation for this would seem to be that workload initially dropped far faster than jobs, as firms sought to hold onto their workforce. Much of the bounce back seems to be down to firms restoring productivity.

Looking forward, though, there would seem little optimism for the construction jobs scene. Vacancy levels are at a low. And the number of company collapses reported of late suggests that construction folk will remain unsettled about their prospects and may choose to sit tight rather than move jobs, restricting opportunities for those out of work.

Furthermore on the basis of the ONS output figures, we have yet to see the full force of the widely forecast double-dip recession in construction.