First of autumn forecasts downgrades construction prospects

Be prepared for a slower recovery than we were expecting – that’s that message from the first of autumn construction forecasts to emerge.

Leading Edge had already penned in a double-dip recession for construction when it last produced a forecast in March, but now it expects the fall to be deeper and the recovery to be slower.

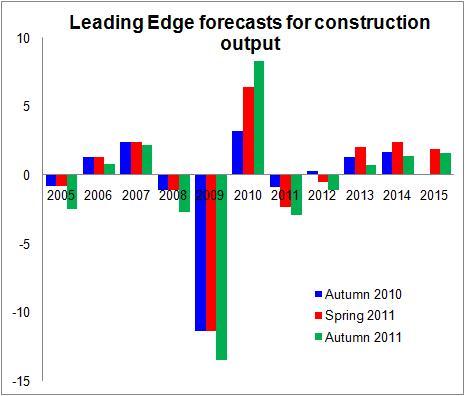

And when we compare the growth rates expected now with those Leading Edge expected a year ago we see that the forecasters now see a longer and deeper second dip to this recession.

And when we compare the growth rates expected now with those Leading Edge expected a year ago we see that the forecasters now see a longer and deeper second dip to this recession.

In fairness part of the reason for the downgrade is technical. Recent revisions by the Office of National Statistics to the official data suggested stronger growth in 2010 than had been thought earlier. So the industry is coming off of a higher base.

As we can see from the graph, which illustrates the past three Leading Edge forecasts for construction output growth rates, the back data has been revised quite heavily by ONS.

But even so the latest forecast reflects the increasing pessimism descending over the industry with prospects for construction over the next three to five years looking increasingly lacklustre.

As we can see the growth rates penned in for the next five years are all noticeably down on previous forecasts.

And it is highly likely that we will see other forecasters downgrading their forecasts for construction in the coming weeks.

What lies behind the growing pessimism is that there is growing doubt over the capacity of the private sector to fill the gap left by a retreating public sector.

This forecast reflects the widening belief that the private sector recovery will be weaker than many had expected and hoped.

Broadly speaking the biggest driver of private sector growth is the general economic activity. Private sector construction tends to respond in an exaggerated manner to changes in GDP.

And what we see in the Leading Edge forecast is shading down in the expectations for GDP growth.

Not surprisingly this translates into a much reduced growth rate for the commercial sector, which one would look to, along with private housing, to drive the recovery in the private sector.

Interestingly the forecast for private housing is broadly better than a year ago, but slightly worse than the forecast produced in March. The expectation is for a year-on-year increase of about 5% from now to 2015.

And the forecasters are more bullish about private housing repair and maintenance.

Looking at the forecast overall the balance works out at a fall of about 4% over 2011 and 2012, before very sluggish growth in the following three years.

But this growth forecast rests on modest to good growth in private sector construction, particularly private housing.

That growth will very much depend in turn on the overall strength of the UK economy. And at the moment there are plenty of uncertainties with the majority of the risks on the downside.