RICS sees some positive signs in the private sector, but its London and South East driven

Viewed from a particular angle the latest construction survey from RICS seems to come out fairly positive given the current circumstances in which the industry finds itself, although it’s not as upbeat as yesterday’s serving from Markit/CIPS.

Workloads are broadly flat according to the RICS survey respondents, which is a bonus in my book given the state of the economy and the outlook.

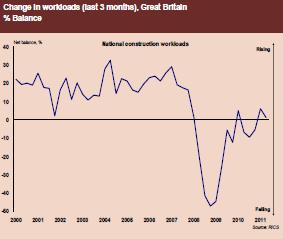

The net balance (see graph taken from RICS press release) moved down from +6 to +2, but at least that is above the zero mark, even if the distinction is more relevant to the industry’s psychological well-being rather than its physical condition.

The net balance (see graph taken from RICS press release) moved down from +6 to +2, but at least that is above the zero mark, even if the distinction is more relevant to the industry’s psychological well-being rather than its physical condition.

More encouragingly the consensus appears to suggest that things will get better, with 10% more of the sample optimistic than pessimistic about workload prospects over the coming 12 months.

There is even a suggestion that there will be more jobs with a +6 balance of firms reckoning they will increase jobs over the coming 12 months. Perhaps more telling, though, is the view on profits, which is pretty heavily negative.

The big question hanging over construction is how strong will the recovery be in private sector construction investment and will it be sufficient to fill the huge gap left by the retreating public sector. The forecasters currently hold the view that the private sector recovery is a bit more pallid than they thought earlier, but fortunately the slide in the public sector is slower than it might have been.

Broadly speaking, the upshot of the thinking among forecasters in their recent forecasts suggest a longer and deeper double dip to the recession in construction, although the dip into recession may occur more gently than they previously suggested.

With large sectors of the industry shifting significantly in different directions, it makes for huge uncertainties over the precise shape of the overall output curve.

But this survey does seem to find positive signs of growth in the private sector albeit long with a rather sharp fall in public sector work. The net balance though does seem to be mildly positive.

Mind you, the positives are rather restricted to London and the South East. The further you move from the capital the more despondent you’ll find the survey respondents. Frankly it is grim for the construction industry up North, where even hope of growth remains forlorn.

Predictably perhaps for regular readers, I feel obliged to dilute some of the delight there might be in these figures on the grounds that the survey probably reveals a limited view of the construction industry.

If there is bias in these figures from its sample and from issues such as survivor bias it probably plays to the upside. Add in optimism bias, which is a problem with surveys such as these, and we should be very cautious in how we read the figures.

I am not sure about the precise detail of the methodology (sorry once again for slackness), but the nature of the sample suggests that it may well over represent the larger firms and larger projects and over represent building above infrastructure.

We have (as far as we can surmise from the official new orders data) a greater proportion of larger projects pumping through the construction pipeline than might be considered historically normal. This suggests the RICS figures may well be on the upside compared with the industry as a whole.

Certainly recent ONS analysis (pdf) showed how small firms were being hit far harder by the recession than larger firms when it came to construction output.

Similarly, there will most probably be a skew in the sample towards new work rather than refurbishment.

Also the RICS membership will work on prospective and speculative projects as well as on-going projects, so shifts in the figures may well be exaggerate by swings in sentiment among clients rather than the swing in how much they are actually spending on the ground at any given point.

This is not to trash the RICS survey. It is an extremely useful tool, particularly as it tends – again because of the mix of respondents – to be a shade ahead of what is happening on the ground.

But as with all surveys, it is best not to follow the bald numbers out of the window, at least not until you have given them some thought.