Forecasters’ views vary on depth and length of construction’s second drop into recession

Hewes & Associates has once again come out with a sobering forecast for the prospects of construction that suggests a deepening recession with no end in sight within its three-year range.

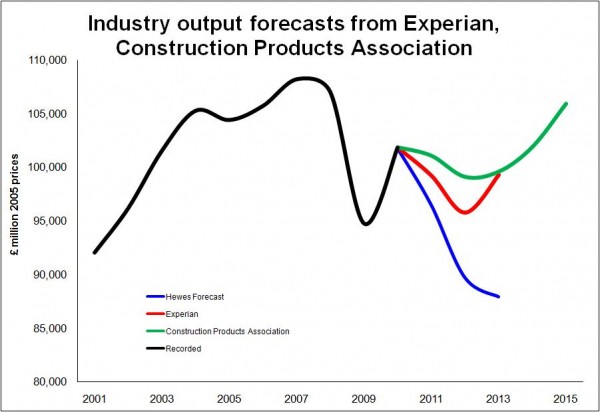

The graph shows how pessimistic the Hewes forecast is when compared with those of the Construction Products Association and Experian.

Underlying this big difference in views between the forecasters is the view on the timing and speed at which the private sector will recover and pull construction back into growth.

Behind this view lies Hewes expectations for GDP, which are for growth to be very weak in 2011 and 2012 and at a rate far below that expected by both the Construction Products Association and Experian.

Hewes does not expect growth in any of the private sectors other than industrial before 2013. And then the forecast suggests there will be fairly weak growth in private housing and private repair and maintenance, along with a continued improvement in industrial work.

Interestingly, it is on the prospects for the huge commercial sector where the Hewes forecast diverges most significantly in 2013 from the others. Experian expects a fairly strong bounce back. Construction Products Association expects a more modest bounce back. Hewes forecasts a slight fall.

The Hewes forecast is also much more negative on the prospects for infrastructure work in 2013.

So, rather than seeing infrastructure and commercial work pulling the industry into growth, Hewes sees them contributing to further falls.

Put in context the Hewes forecast expects construction activity in volume terms to fall by 2013 to levels last seen in early 1988.

But Hewes has tended through this recession to take a more pessimistic view and has does tend to factor in more of the downside risks.

As I have said before the spread of views captured within recent industry forecasts is far greater than we would normally expect. This suggests a far greater spectrum and scale of risks that lie ahead.

How one represents these risks in a mathematical or graphical form within forecasts is not easy and is a subject of much debate.

What we can say is that there appear to be more downside risks to construction and the big risks appear to be almost exclusively on the downside.