Half-term report for the housing market 2011 – fragile and flatlining

The two best words to sum up the picture that emerges from the latest housing market data would probably be fragile and flatlining.

The surveys may have slight differences, but they all point to a market in a state of uneasy equilibrium.

So, with a steady flow of disappointing economic data of late, this leaves wide open the question of whether the market has the resilience to avoid being tipped again into decline.

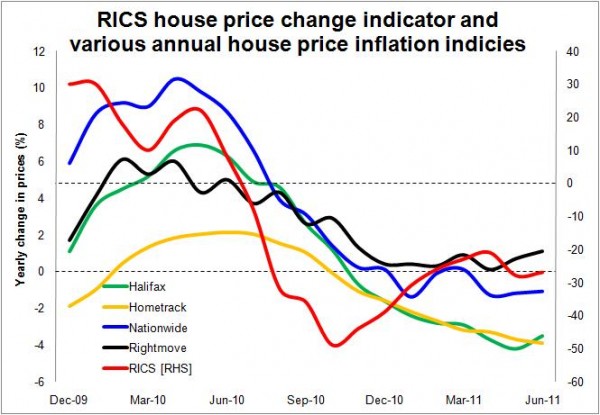

The graph probably shows you all you need to know about the general pattern of house prices. Having enjoyed a surge, prices have fallen back and are now following a fairly stable path, with most regions falling slightly and London prices increasing.

The best way to describe the regional variations evident in the data would be to say simply that London is doing well while most of the rest of the UK is struggling.

But with a market not functioning properly at transaction levels between a half and a third below historically norms, the survey results are more open to question.

And there is little sign that transactions will bounce back in the near term, other than perhaps in sporadic blips.

The number of mortgage approvals remains limp. Over the six months to May this year there were about 4% fewer mortgage approvals for home purchase than in the previous six months and about 9% fewer than in the same period a year ago.

Across the piece, the slight increase in interest from sellers that prompted more to enter the market earlier this year is showing signs of petering out, while there is little evidence on increased numbers of buyers.

This led the surveyors’ body RICS to suggest that there is stalemate between buyers and sellers.

Despite continued uncertainty in the general housing market, there is a sense that housebuilders are less nervous now than they were a few months ago

Two phrases seem to sum up recent trading statements by the major housebuilders: stable market and higher margins. It seems from some statements that the market jitters of last autumn unsettled bosses quite a bit and that things did not get worse was a real comfort.

Mind you, one advantage house builders do have above other sellers in the market is that they have greater flexibility to target what type of buyer they are looking for and where.

So they have been able, to some degree, to pick the more liquid and profitable sectors, such as the upper end of the market where mortgage constraints are less problematic. Nationals firms meanwhile have also been focussing greater effort in the more affluent south.

Not that they are shying away totally from the first time buyers. They are happy to see a new form of HomeBuy Direct scheme in the shape of the FirstBuy government backed-shared equity scheme. This will underpin a few thousand sales to first-time buyers.

For all the confidence that the housebuilders may be showing, there can be few in the housing market outside London without concerns over what path the economy and the housing market in particular will take in the second half of this year.

There is some comfort for those selling into the housing market. If demand falls and buyers retreat, sellers have shown that they are prepared to pull back also.

Low interest rates and a buoyant rental market have allowed them to avoid pressured sales and sit out a slough in buyer interest by staying put or renting out the home. Recent surveys have shown that households appear happier than before to upgrade their existing home rather than move.

All this should help to underpin prices.

This comfort for sellers and house builders, however, comes at a price. If demand softens and prices hold firm there will almost inevitably be lower levels of transactions which in turn points to fewer homes sold and fewer homes built.