Construction output: So far it’s better than last year, but can that last?

The construction firms may be suffering and may be shedding jobs, but the bald statistics so far for this year suggest that the industry is faring better than the gloomy news might have some believe.

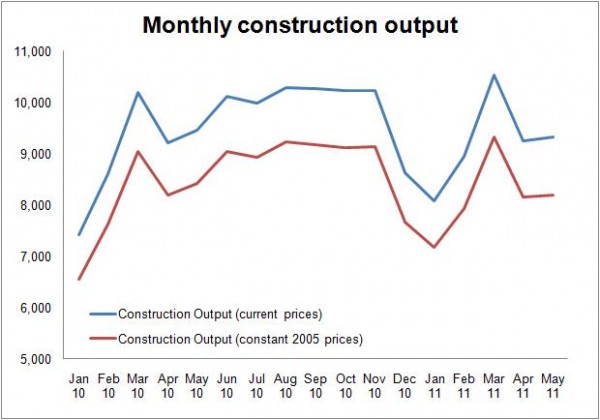

The latest construction output figures show that in pure cash terms the industry pocketed about £1.24 billion more in the first five months of this year than in the same period in 2010. And 2010 proved a pretty good year in the end, with output rising by a hefty 7.7% in volume terms.

But can this be sustained?

The surge in work in the mid-year months of last year certainly put further distance from the dark days of early 2009, as the industry benefited from the previous Government’s fiscal stimulus and a perking up in some quarters of the private sector.

But the unsettling truth is that the path of construction for the rest of this year remains pretty uncertain.

As we can see from the graph, between June and November 2010 the industry did a lot of work.

The big question is whether we will see a similar surge in work in the mid months of this year. And on this point next month’s output figures may prove enlightening.

From where we stand, it is easy to see why many might choose to dismiss the gloomy forecasts of a dip into the next wave of a protracted depression for construction. But there are good reasons why many experts are wary about the future.

Certainly, one factor that appears from the data to be at play in supporting construction activity at present is the resilience of public sector work. It is not falling away as fast as might have been expected and we saw the Construction Products Association tweak its latest forecast to take this into account.

This is certainly good news in the short-term, as it is providing work for firms and jobs for workers. But it does raise the awkward question of whether this means a sharper fall in publicly-purchased construction work further down the line.

Will the Chancellor relent and let public spending on construction run ahead of his budget plans?

A second point – one I haven’t seen mentioned as much as it perhaps should be – is that during the latter part of the last decade there was a surge in the orders for larger projects.

In 2009 projects worth £10 million or more accounted for about 40% of the contracts worth above £100,000. This compares with 21% in 2003.

Even allowing for inflation this suggests a big surge in the proportion of large contracts. And this inevitably has reshaped the way work flows through the pipeline.

So, while the official figures show a collapse in new orders to about three quarters the level seen before the global financial crisis, the impact of this fall will have been muted as the greater number of bigger projects already in the pipeline takes longer to work through.

But as these larger projects come to an end there will be fewer of equivalent scale entering the pipeline to replace them and less work in general coming through.

This too raises the prospect of a rather more abrupt drop off in work on the ground than might otherwise be expected.

Thirdly, what is more worrying is that there is little sign in either the output figures or new orders figures to suggest that there is enough momentum in the private sector to be able to pick up the slack when the public sector work finally does collapse, as the Government spending figures suggest it must.

So, while we should enjoy the fact that the industry has been busier so far this year, there are serious questions over whether this can be sustained.