Building materials imports data suggest construction grew in first quarter of 2011

The value of UK building materials imports rose 3.7% in the first quarter of this year compared with the final quarter of last year, which had seen a fall of almost 10%.

This rather suggests that the construction industry had a better start to this year than the official output figures might indicate.

Because while rising imports is not good news for the UK balance of trade, it does rather point to more activity on construction sites in the first three months of this year than in the final three months of 2010.

If this is so it would add a tad more weight to the view that the official construction output data might be slightly out on the timing relative to the work actually being done on the ground.

There’s a view that after the heavy snow in December 2010 paralysed many construction jobs, output should have picked up in the first quarter.

This, according to the official data, didn’t happen. Output dropped further in January and in the end output in the first quarter of 2011 was down 3.4% in volume terms compared with the final quarter of 2010.

This has led to suspicions that there is a lag in the data. The materials imports data would seem to support that suspicion.

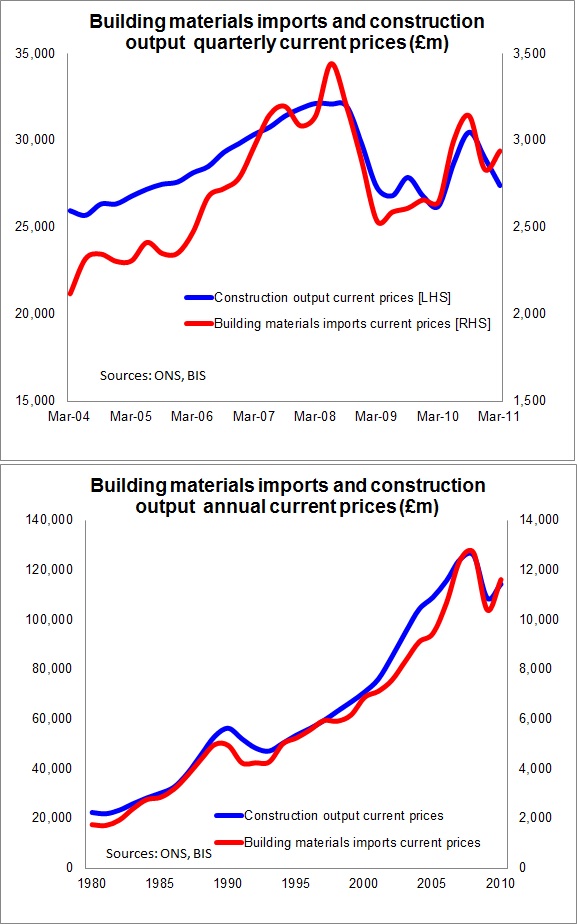

Certainly, there does appear to be a strong link between building materials imports and output, as the graphs show.

But before drawing too many hard and fast conclusions there are some health warnings that should be considered.

The material imports figures should, if anything, run slightly ahead of the output data, given that the materials have to be in the country before they can be used on site. Although a crude examination of the data doesn’t suggest that any lag effects are likely to be more than a few weeks.

But more importantly the materials imports figures are in cash prices. And with the exchange rates fluctuating this will distort the amount of goods imported for a given sum in Sterling.

Furthermore prices have been very volatile and the rates of inflation for different materials have varied widely over the past three to four years.

But while the materials imports data may support the criticism that there is a lag in the construction output data, it does seem to support the picture painted by the official construction output statistics that there was a very strong surge in work in the mid part of last year. This has also been the subject of some scepticism.

Further, while the surge in imports in the second and third quarters of last year seems very much to support the spike in growth recorded in the official construction output data, the figures also supports the view that construction activity was notably higher in 2010 than in 2009.

The materials imports figures show a rise of about 12% in the value of building materials imported.

Now this may mostly have been down to rising prices in the face of a weak currency, but this seems unlikely.

If we focus on just one of the product streams measured, we see that the value of imported wooden doors rose by about 18% in 2010 and imports of other wood products rose by a similar scale.

And most of this increase in 2010 was during the second and third quarters. The value of imported wooden doors in 2010 Q2 was up 15% on the previous year while the value in 2010 Q3 was up 41%.

Meanwhile inflation in average timber prices across both 2009 and 2010 was far below 18%.

Certainly something was going on and naturally there are other possible explanations for the surge in imported windows – restocking may be one. But without further scrutiny it does seem, from these figures at least, as if there really was a strong surge in construction work in the middle quarters of last year.