November construction output figures suggest it’s downhill from here

Construction output is beginning finally to show signs that it is falling into a much-expected second dip into recession after the stimulus-propelled growth earlier this year.

The latest figures from the Office of National Statistics show that on a moving three-month basis the industry contracted by 1.5% in volume terms in November.

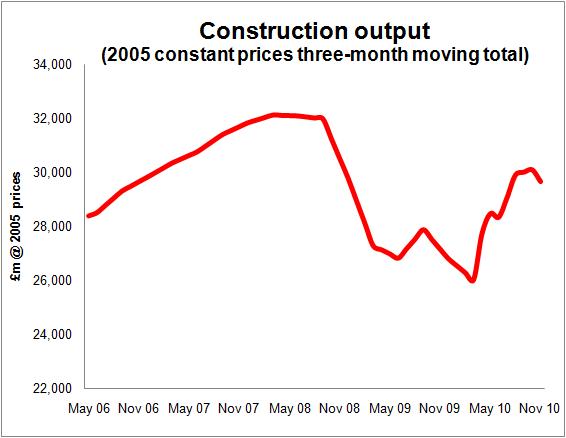

The graph (right) shows the moving three-month total for output, with simple straight line estimates for monthly movements in the totals made for the pre-2010 data, which was produced on a quarterly basis.

The graph (right) shows the moving three-month total for output, with simple straight line estimates for monthly movements in the totals made for the pre-2010 data, which was produced on a quarterly basis.

In that context it can be seen that the November tick down looks pretty significant.

But while this all fits with the idea that construction is now declining, there are caveats with the data that should be considered. It is possible (probable) that the 1.5% decline will end up smaller after future revisions.

The new series introduced last January is bedding in and various tweaks have been made to data processing, including in the way estimates are made for non-responding businesses. A change in the method of imputation was one reason for major revisions in the data with the release of the third quarter figures for last year.

I won’t go too deeply into the technical details for fear of revealing my own ignorance, but the method used for imputing values for non-responding firms does appear at the moment to be underestimating the actual value of work undertaken.

This means that when real data from late returns is added to the existing data and the more complete data is reprocessed the figures are being revised upward, rather than there being a more random spread of positive and negative revisions as one might expect when late returns are added (if that makes sense).

Since the third quarter figures were published the revisions have added about 2% to the recorded construction output in cash terms, or crudely put that would add about £2 billion to the recorded annual output.

But basically what I am saying is expect November’s figure to increase next month proportionately more than, say, June’s figure. And so expect the three-month on three-month decline of 1.5% to be reduced albeit slightly – all other things being equal.

Also it is unclear what seasonal effects may be at work here. So again we should be a bit caution in drawing too many conclusions other than it’s pretty likely a peak has been reached and its downhill from here.