Imports figures support official stats showing a strong bounce back for construction in 2009

Here’s a couple of graphs that hopefully will bring a little Christmas cheer to the statisticians at ONS who have been putting together the much queried new construction output figures.

They may also bring a little cheer too to the statistics team that puts together the building materials imports figures, which also come in for criticism from time to time.

Constant criticism, sadly, is the lot of the statistician.

(And in the spirit of credit where credit is due, I might add that I am indebted to the team at BIS for updating the December spreadsheet with the late arriving import data rather than waiting until next month.)

Anyway, the graphs show construction output and building materials imports, both at current prices. And, before you ask, there is no direct connection between how these two sets of data are collected, as far as I know anyway.

Anyway, the graphs show construction output and building materials imports, both at current prices. And, before you ask, there is no direct connection between how these two sets of data are collected, as far as I know anyway.

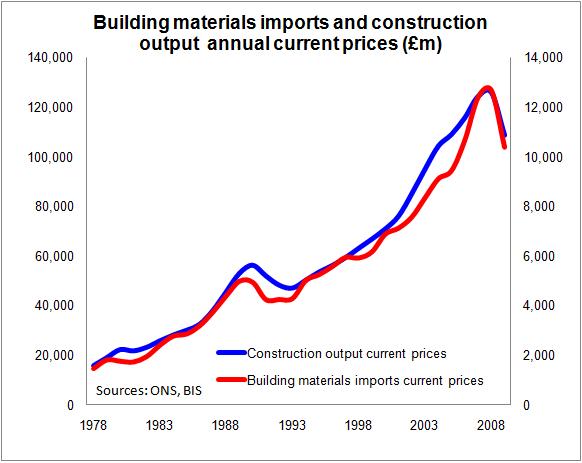

What the data appear to suggest is that for every £1 of construction work undertaken we import 10p worth of materials. And that relationship seems to have persisted for the past 30 years or more, as you can see from the first graph.

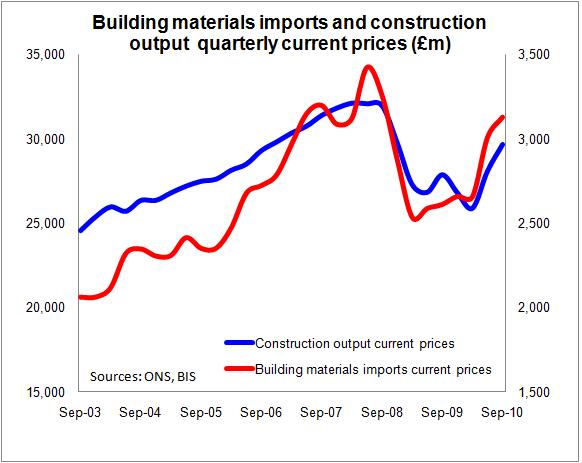

But turning to the second graph, which plots the data quarterly, the sharp rise in building materials imports in the mid part of this year does neatly correspond with the rise in output.

This adds some supporting evidence to the fact that, as the stats show, there was a fairly robust bounce back in construction in the second and third quarter of this year.

Naturally as someone who has been arguing for some time that there might well have been an under recording of construction in the run up to the latest peak, I am happy to see support for that view by pointing at the different pattern in the paths of the two lines during the latest boom to bust compared with previous recessions when we examine the first graph.

Naturally as someone who has been arguing for some time that there might well have been an under recording of construction in the run up to the latest peak, I am happy to see support for that view by pointing at the different pattern in the paths of the two lines during the latest boom to bust compared with previous recessions when we examine the first graph.

That is always assuming there really is as strong a link between construction output and building materials imports as the graphs suggest.

Certainly, why the correlation should be so close is a bit puzzling given the impact of changing exchange rates, the relatively volatile prices of raw materials and the fact that timber represents such a large portion of the imports.

Anyway, perhaps we have here the seed of an idea for a dissertation topic for a student of construction economics?