Halifax shows continued slide in house prices…but the real market test comes in the New Year

The Halifax house price index crept down today and appears to be on a path of slow decline, which is broadly in line with most other house price indicators.

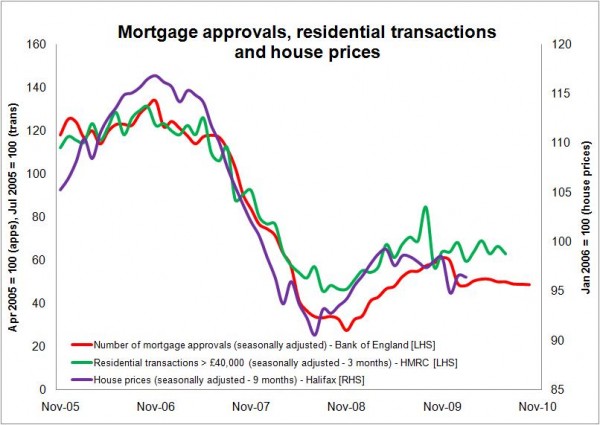

And as we can see from the graph transactions remain subdued and mortgage approvals are also on a gentle downward slide.

But while the current slide in the market may be unsettling, it will be the next few months that will prove particularly nail biting for those whose fortunes are pinned to selling homes.

But while the current slide in the market may be unsettling, it will be the next few months that will prove particularly nail biting for those whose fortunes are pinned to selling homes.

The big test for the market will be how it reacts when the thumbscrews are turned on households with the rise in VAT next year and a potential rise in uncertainty in the jobs market, as the ranks of the unemployed swell with more public servants looking for work.

Certainly this is not a time for unbridled celebration for estate agents.

While the blame for the markets current woes is being pinned on mortgage lenders, it must be remembered that the effect of falling rates has boosted the cash in mortgagees’ pockets by about £20 billion a year. No small boost.

If you can raise the deposit the cost of a mortgage is historically very low.

And in fairness it would be folly to heap too much blame on lenders for not doing what they have been slapped for doing before the credit crunch – taking big risks. If they genuinely fear a house price fall, quite rightly they should demand a high deposit.

Looking at the runes though, it is unlikely that any solace will come from that quarter in the near future with access to finance made easier. Indeed the reverse may be more likely.

So it looks like we are stuck with more downside than upside risks in the market.

However on a brighter note, the good news for house builders is that some of the cost burden and potential cost burden appears to be lifting. Jules Birch quite rightly in a blog today points out that this should help to boost land values.

This will have a dual effect. Firstly it will reduce the damage to house builders that might be caused by sliding prices. Secondly it may bring some schemes that were unviable back into the realms of developable.

And looking further into the future, the rather crude mechanism that is the New Homes Bonus – which ironically isn’t just about new homes and isn’t really a bonus – may provide leverage for house builders in their negotiations and probably renegotiations around section 106 contributions.

This again looks as if it could provide more security against potential dangers that might face house builders in the coming year.

But as things stand with interest rates looking to remain in super-low territory for some time yet, I suspect a dramatic drop in house prices remains a fairly remote possibility. Sellers are better placed to just remove themselves from the market rather than crystallising losses – however notional those losses might be in reality.

However, for the wider construction industry and the nation as a whole, without doubt one of the real costs of this uncertain period is the level of new house construction. If I were a betting person, I’d be tempted by and odds on bet that next year we see fewer homes built than this.

And to heap more unseasonal uncheer on the matter, looking further forward the industry will have to negotiate the effects of a rise in interest rates. The question here is: how long can we run this economy on negative real interest rates?