Inflation – a reason to be cheerful or a cause for concern?

The rate of inflation is important to construction at present, especially to those engaged in the housing market that might be wary of high inflation rates prompting increases in interest rates or deflation prompting prolonged falls in house prices.

But it seems to me that people fall in reasonable proportions into three camps, those who fret about inflation rising, those who remain pretty relaxed and those who fret about deflation.

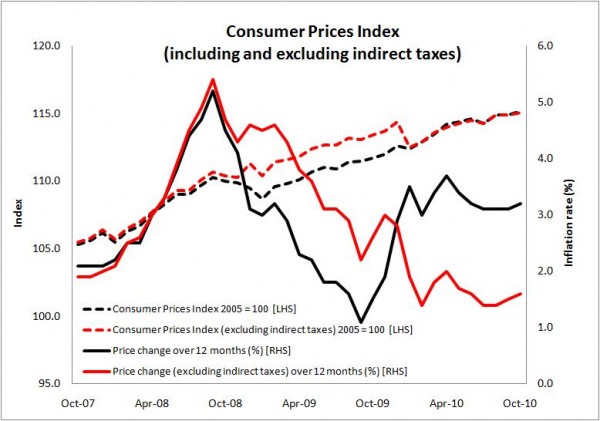

So here is one graph that oddly might satisfy all sets of proclivities. There is a bit of something for everyone here.

So here is one graph that oddly might satisfy all sets of proclivities. There is a bit of something for everyone here.

If we start with the latest rise in the headline rate of CPI inflation to 3.2%. That was expected and the Governor of the Bank of England will have to write a letter to the Chancellor – those facts will predictably grab the headlines in the news bulletins.

But frankly reading sense into the headline rate of CPI inflation is not as easy as it might seem from listening to the news. Troublesome base effects caused by the temporary cut in VAT create all sorts of mental arithmetic issues with the CPI rate dropping faster on the cut and jumping on the restoration of the full VAT rate.

This we can see from the movement of the solid black line in the graph.

And we will face that troublesome mental arithmetic all over again when the VAT rate rises to 20%.

It we look at the rate minus the impact of indirect taxes or CPIY as it is labeled in the inflation measuring trade (that is the solid red line) we see the downswing in inflation from the 2008 surge was steadier than the headline rate and we have not had the jump caused by the restoration of full rate VAT, which in time will work its way out next year.

But before then the rise in VAT to 20% will cause another blip upward in the headline rate of CPI in January, which will in effect establish a new base level. This blip could possibly take the headline CPI rate close to 5% (apologies for an unspotted miskey) 4% from possibly around 3% in December.

After that the base effects lingering from the earlier cut in VAT should still create a gentle easing in the headline rate from the newly set high as the year progresses.

Headline rate of inflation – headache rate more like.

So concentrating on CPIY should provide a better feel for what is going on. That is not to say that imposing more VAT does not have a direct effect on inflation or pricing. It does and will act to suppress ex-tax prices – or it should do.

So what does our graph show us?

The rate of inflation when we strip out the effect of changing taxes is 1.6%, well in the comfort range as far as the Bank of England Monetary Policy Committee target is concerned.

That is one for those who are relaxed about inflation.

But while there is little hint of deflation in the graph the trend has broadly been downward through the recession and we have yet to feel the effects of the public sector squeeze and VAT rise.

That propsect should continue to feed the deflation fretters.

But we have started to see, for two months on the trot, prices rise from 1.4% to 1.6%and there is some pumping up of producer prices in the pipeline. That will feed the fears of the fretful over rising inflation.

Mind you there will be those who will dismiss this worry and put the rise down to retailers repricing in anticipation of the VAT rise.

So there we have it, something for everyone in today’s CPI figures. Although not perhaps for the members of the MPC who will have to fix on a view based on their various positions on the fret-relaxed-fret scale and come up with a credible policy on interest rates and quantitative easing.

Still they did have 10 relatively easy years.

As for the record on where I stand on that fret-relaxed-fret scale, well I remain of the view that I have held for some while that in the mid term there is less downward pressure on inflation than it would seem the rate setters think.

But hey it’s just a view and frankly, with the economic experiment we are just about to embark on in terms of public sector savagery, the unknowns are so great that it’s anyone’s guess.