More than 300,000 construction jobs axed so far in this recession

Construction lost 63,000 jobs in the first quarter of this year and has shed more than 300,000 since the recession bit hard after Lehman Brothers collapsed in September 2008.

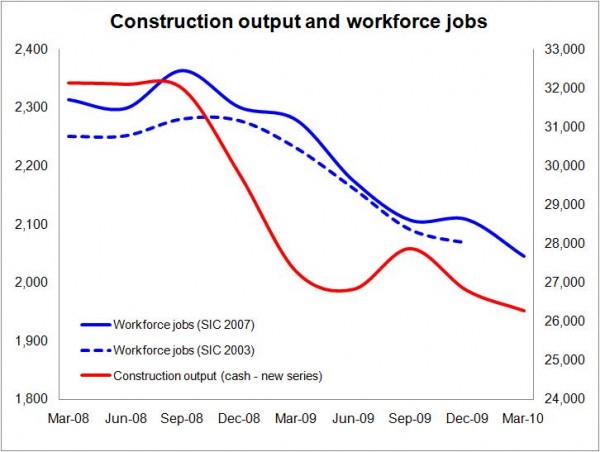

The latest employment figures are based on a slightly different assessment of the industry (Standard Industrial Classification 2007 is used) and paint an even gloomy picture of the trajectory of construction jobs than did the previous series (see graph).

At peak in September 2008 the statisticians now reckon there were 2,364,000 jobs in construction. By the first quarter of this year than number had fallen to 2,045,000.

At peak in September 2008 the statisticians now reckon there were 2,364,000 jobs in construction. By the first quarter of this year than number had fallen to 2,045,000.

Meanwhile, the latest figures also show that while redundancies are fewer than in recent quarters they are still running at high levels. 29,000 were recorded for the first quarter of this year, suggesting further downward pressure on the workforce figures.

And recorded vacancies continue to run at the historically low level of about 10,000, which is about a third of the pre-recessionary level.

With savage cuts to public work on the way it seems highly likely that the path of jobs in construction will remain southward facing for some time yet, with prospects for young talent to progress severely dented.

There will be some who draw comfort from the headline employment figures for the whole economy. The level of employment (measured on a three-month moving average) was seen to rise over three consecutive months and unemployment drop for two consecutive months on the same measure.

But it doesn’t take much talent in forensics to suss out that this is mainly down to the rising numbers of self employed and the swelling ranks of part-time employees. The number of full time people employed is continuing to fall.

Rather than providing a picture of comfort, these figures provide intrigue. They suggest that the employment landscape may be, perhaps, significantly changed from the past, less rigid if you like, and so should be interpreted differently.

This view rather chimes with some of the comments made in the latest employment prospects analysis by the Chartered Institute of Personnel and Development (CIPD).

Today it put out a stark warning on unemployment prospects for the UK.

It takes a far more downbeat view of jobs prospects than the Government and the Office for Budget Responsibility. CIPD expects unemployment to grow to 2.95 million in 2012 and remain close to 2.5 million by 2015.

This is based on a less optimistic view of growth within the UK economy than the OBR forecast.

Over the past 30 years it says that it has taken growth of about 2.5% in the economy to generate 1% growth in jobs and it does see growth on that scale until 2013.

But, it notes, this time jobs growth may be more subdued it warns as a result of “hoarding” by employers which has meant unemployment has grown less than might have been expected in the downturn.

This has led to lower productivity and, says CIPD, it is probable that employers will wish to increase productivity before engaging in aggressive hiring.

Further it warns that things might prove far worse if the UK does slide into a double-dip recession, although it says it is not in the camp of those who expect this to happen.

For construction, concerns over poor rates of job creation spread well beyond those employed or not employed by the industry itself.

Employment prospects are critical for the housing market as the reality, or even the fear, of unemployment will dissuade buyers, increase distressed sales and increase caution among lenders. This pattern, all other things being equal, reduces the number of buyers and increases the number “deals” on the market, suppressing prices.

In this environment builders will be far more cautious to open new sites and may struggle with those already open.

Fear or the reality of unemployment is also likely to impact on consumers and so place stress on retailers. Given that the intention of the Government is to rebase the economy away from consumption weak employment prospects may leave retailers and distributers less inclined to spend on new shops and warehousing.

In a world of uncertainties, one thing is for certain: as the effects of public sector restructuring and the fiscal squeeze of the rise to 20% in VAT bear down on the economy there will be plenty of bosses in construction firms nervously gauging the impact of the measures on the private sector on which so much now rests.

We are folks in what looks like an experimental phase in the economy. From here it is anyone’s guess what might happen – and there are plenty of people guessing very different outcomes.